Why the AI ‘overhype’ is positive for our top picks from the Magnificent Seven

Friday 19 July 2024

Investing insights

We are now halfway through 2024, almost two years into the ChatGPT-sparked obsession with all things AI. Undoubtedly, AI has pushed markets to unexpected and much-debated new heights. So far in 2024, the S&P 500 has advanced ~15%, powered largely by mega-cap tech stocks.

Specifically, the moniker Magnificent Seven first surfaced in April 2023 to signify their importance in driving the market. I previously discussed the group and top picks in July 2023 and in January 2024.

Concern has built up around the sustainability of the market momentum, particularly in the megacaps in the face of potentially stalling macro conditions and political uncertainty. The words ‘technical fragility’, ‘breadth deterioration’, and ‘profit struggles’ come up often in the discussion.

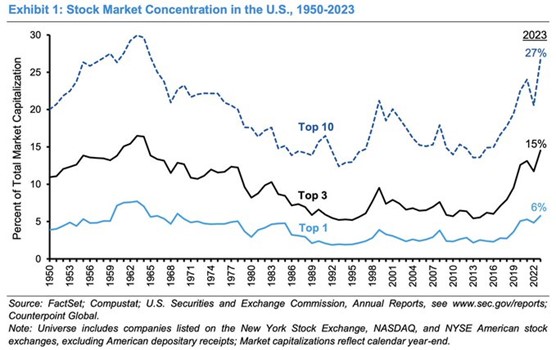

It is easy to see the following chart and conclude, “The megacaps have run up so much from the AI hype while the rest of the market has lagged and the reversion to historical concentration levels is bound to happen soon”.

Indeed, the AI theme has driven half of the MSCI All County World Index’s 11% return year-to-date. As per Citi Research, stocks with high AI exposure are up 36%, and stocks with medium exposure are up 9% while non-AI stocks have lagged, gaining only 6% so far this year.

So is the AI-driven market pure hype? Are the Mag Seven destined to revert to the mean?

At Swell, we are neither macro forecasters nor technical analysts looking to make predictions based on history and charts. We aim to develop a deep understanding of the forward-looking and fundamental drivers that contribute to a company’s intrinsic valuation.

Fundamental drivers and future expectations of the Mag Seven

Yes, the AI narrative drove a significant portion of the growth.

Stocks with high exposure to AI benefitted from the dual tailwinds of expanding P/E multiples and upwards earnings revisions which contributed 22% and 14% respectively to the overall 36% increase.

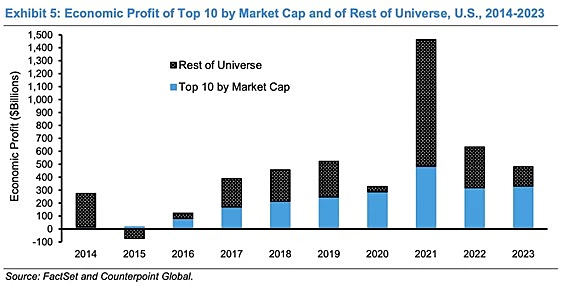

Yes, there is high concentration in the largest megacaps vs the historical average. However, the concentration is supported by fundamental drivers.

From 2014 to 2023, the top 10 stocks were on average 19% of the market capitalisation and 47% of the total economic profit. In 2023, the top 10 equities were 27% of the market capitalisation and 69% of the total economic profit.

Let’s decompose the fundamental drivers of the stock price for the Mag Seven.

| Year to July 3 2024 | Stock price change | Revenue growth | EBIT growth | LTM P/E growth |

| Nvidia | 189% | 209% | 962% | -70% |

| Meta | 78% | 22% | 70% | -18% |

| Alphabet | 55% | 20% | 31% | 5% |

| Amazon | 54% | 13% | 233% | -83% |

| Microsoft | 36% | 14% | 24% | 5% |

| Apple | 14% | -1% | 5% | 4% |

| Tesla | -17% | 10% | -42% | -23% |

Source: Bloomberg, Swell

We can see from this table that stock price changes were largely driven by revenue and operating profit growth. Prior to 2023, the market underestimated the resiliency of the group, excluding Apple and Tesla, in terms of price momentum and earnings revisions.

Let’s look at consensus expectations for the Mag Seven

| EPS 3 year growth | FCF 3 year growth | PE 2026 | |

| Nvidia | 53% | 54% | 30.3x |

| Meta | 24% | 15% | 18.7x |

| Alphabet | 20% | 11% | 18.9x |

| Amazon | 41% | 43% | 26.4x |

| Microsoft | 18% | 15% | 29.4x |

| Apple | 8% | 6% | 28.6x |

| Tesla | 17% | 28% | 54.3x |

Source: Bloomberg, Swell

From the above table, we can see that some of the stocks are certainly not overvalued and potentially undervalued if earnings growth expectations are met or exceeded.

Are the expectations too high?

The current capex spending environment points to a potential AI overhype as the hyperscalers are racing to build out computing capacity.

Nvidia’s CEO aptly summarised the competitive landscape:

“Let me give you an example of time being really valuable, why this idea of standing up a data centre instantaneously is so valuable and getting this thing called time-to-train is so valuable. The reason for that is because the next company who reaches the next major plateau gets to announce a groundbreaking AI. And the second one after that gets to announce something that’s 0.3% better. And so the question is, do you want to be repeatedly the company delivering groundbreaking AI or the company delivering 0.3% better? And that’s the reason why this race, as in all technology races, the race is so important.”

This echoes the dot-com bubble era, where companies overbuilt fibre infrastructure, leading to severe downturns. Cisco, once a titan like Nvidia, saw staggering earnings growth of 71% annually from 1991 to 2000 before the bubble burst and its valuation plummeted from the highs of 233 times trailing earnings.

The question looms: could history repeat itself with a potential AI bubble?

Below I lay out some reasons on why this time is indeed different.

- Unprecedented Market Size: prominent investors and executives predicting that the market for A.I. will be bigger than the markets for the smartphone, the personal computer, social media and the internet.

- Sustainable Growth through Infrastructure Investment: Unlike recent tech trends characterised by speculative IPOs and SPACs, AI growth necessitates substantial upfront investments in infrastructure that are integrated into existing leading platforms with proven monetisation models.

- Flexible Solutions from Hyperscalers: Major tech companies offer scalable AI solutions with a focus on clear return on investment, allowing businesses to adopt AI at their own pace, unlike the one-size-fits-all approach of earlier tech waves.

- Post-COVID Digitisation Focus: The pandemic accelerated businesses’ focus on digitisation. Companies are integrating AI into full-stack business models, balancing innovation with practical scepticism.

- Accelerated AI Adoption and Innovation: The adoption of AI is accelerating rapidly, with 65% of organisations now utilising generative AI, doubling year on year, according to McKinsey. There are >50,000 generative AI patent applications filed in the past decade, 1/4 of which were filed in 2023 alone.

While AI-driven momentum may wane as real investments take time to scale and positive returns gradually reflect in financial statements, the underlying transformative force has lasting implications for investors.

It can be argued that the bigger the hype, the faster the technology adoption, the bigger the opportunity for the enablers.

Top performing stocks year to date

The top-performing stocks this year highlight the diverse array of companies benefiting from this technological surge, particularly those involved in AI infrastructure such as physical computing equipment and renewable energy.

- Super Micro Computer (SMCI): +209.3% (YTD to 01/07/24)

- Nvidia (NVDA): +187.7%

- Vistra (VST): +125.8%

- Constellation Energy Corporation (CEG): +85.9%

- Micron Technology (MU): +65.8%

- GE Aerospace (GE): +60.5%

- NRG Energy (NRG): +54.3%

- Eli Lilly and Company (LLY): +51.5%

- CrowdStrike Holdings (CRWD): +48.6%

- First Solar (FSLR): +48.3%

This year, hardware-tech stocks have outperformed software peers by 30 percentage points in contrast to the past decade, where software firms outpaced hardware by over 250 percentage points. The hardware sector’s ability to lower computing costs is spurring innovation and new use cases, making it a pivotal player in the AI revolution.

The next stage: cloud computing and beyond

Predicting which application and software players will dominate is challenging, but it’s clear that the majority of AI training and inference will rely on cloud computing. This sector is crucial for the next phase of AI development, with cloud providers being the key beneficiaries.

- Hyperscalers’ Capex and R&D spend: Major players like AWS, Microsoft, Meta and Google are projected to increase their capital expenditures from $130+ billion (17% of revenue) in 2023 to $200+ billion (22% of revenue) by 2025, as they meet the growing demand for high-performance computing. Together, they command a significant 20% share of total capital expenditure and R&D spend in the U.S., underlining their growing financial prowess and technological influence.

- GPU capacity and revenue: There are over 8,000 data centres globally, up from 3,600 in 2015, and expected to double in the next 10 years. Nvidia highlighted in a recent call that for every $1 spent on their AI infrastructure, cloud providers can earn $5 in GPU hosting revenue over four years, indicating a swift return on investment that has yet to play out.

Cloud providers stand to benefit significantly from the shift towards AI, generating substantial revenue from AI workloads. The integration of generative AI is expected to revolutionise various sectors, including enterprise software, digital advertising, eCommerce and entertainment.

The Magnificent Seven: top picks

At Swell, we focus on companies that have:

- Strong balance sheets capable of withstanding economic fluctuations.

- High-quality revenue that demonstrates growth potential over a 3–5 year horizon, irrespective of short-term volatility.

- Margin expansion opportunities through economies of scale and strong management.

- Growing free cash flows especially within the context of substantial capex investments.

- Optionality to leverage infrastructure and computing capacity for both internal and external uses, depending on the adoption curve.

Amazon

- D/E ratio 74.1%; Cash position $73 billion; Interest coverage 16x

- FCF 3-year compound annual growth (Swell estimates): 55.8%

- Compute external use – AWS

- Compute internal use – Amazon retail operations, Advertising, Prime-related benefits, Alexa smart assistant

- D/E ratio 9.7%; Cash position $24 billion; Interest coverage 301x

- FCF 3-year compound annual growth (Swell estimates): 16.1%

- Compute external use – Google Cloud

- Compute internal use – Search, Advertising platforms and tools, Productivity tools and business applications, Android

These two companies have in common strong expanding moat of existing scale of users and customers, unique data, AI capabilities and infrastructure.

Balance short term volatility with long term gains

There are risks in the short-term where upfront capex reaches extreme levels but the revenue from those services comes through far more slowly than is hoped. As a result, margins are lower and valuation multiples fall, reversing the momentum. However, this would present valuable entry points for the long-term investor.

Investors should look for opportunities in companies that are well-positioned to capitalise on the AI revolution, balancing short-term volatility with long-term growth potential. The ongoing evolution of AI and its infrastructure presents a unique chance to invest in the future of technology and innovation.

This article first appeared on livewire on July 5 2024