Fantastic Four is the new Magnificent Seven

Tuesday 30 January 2024

Portfolio insights

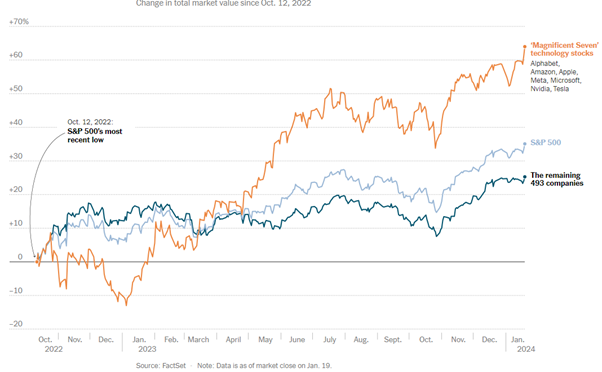

The S&P 500 is up 36% from September 2022 lows and 60% of the unexpected performance is attributed to the Magnificent Seven. The seven stocks — Alphabet (+68% YTD), Amazon (+60% YTD), Apple (+50% YTD), Meta (+196% YTD), Microsoft (+77% YTD), Nvidia (+303% YTD) and Tesla (+70% YTD) — have collectively risen nearly 117%, far outpacing the performance of the other 493 companies in the S&P 500.

In July 2022, I wrote the article titled “The Magnificent Seven – how they got here and where will they go?” I discussed several factors that led to their outperformance including tapering rate hike expectations and the generative AI hype.

Since then, the group continued to outperform.

In recent months, the rally has broadened, with an increasing number of companies participating in the upswing. Over half of the firms in the index have surpassed their values since the S&P’s last high in January 2022.

Some suggest this indicates the rally might continue to expand, as stocks that were previously underperforming start to recover, fuelled by a more positive view of the economic future. However, others caution it could just be a temporary upturn preceding a decline, particularly as the ongoing economic deceleration impacts these companies.

Leaving economic forecasts to economists, I continue to focus on business fundamentals and quantifiable opportunities.

One key metric

As noted in my earlier article, we focus on finding quality companies defined by low debt, strong free cash flow and sustainable earnings growth regardless of economic conditions. These characteristics, which underpin Swell’s investment philosophy, will continue to outperform in 2024 and beyond, regardless of the macro environment.

One metric that ties these characteristic together is Return on Invested Capital (ROIC).

A high ROIC speaks volumes about a company’s management – their ability to be exceptional capital allocators and strategic decision-makers. A company that consistently achieves an ROIC higher than its cost of capital demonstrates resilience and capacity for thriving in competitive environments.

Consider the burgeoning field of generative AI, which requires substantial capital expenditure and research investments. But here’s where high ROIC becomes key. Companies that can generate high returns on these investments are likely to be the frontrunners in the AI revolution. They’re not just throwing money at a trendy sector; they are strategically positioning themselves at the forefront of technological innovation.

Generative AI is not hype

As 2023 unfolded, we saw increasing evidence that generative AI is not hype.

- AI is rapidly gaining ground – over 70% of organisations are now using managed AI services.

- Still early days –32% of organisations still appear to be in the experimentation phase with these tools, deploying fewer than 10 instances of AI services in their cloud environments.

- Scaling phase represents >5x opportunity –10% of businesses have deployed 50 or more instances in their environments.

(Source: Wiz State of AI in the Cloud in 2024, sample size of over 150,000 public cloud accounts)

We predict that in 2024, as AI compute capacity and AI-powered products become more accessible, the generative AI opportunity will move beyond the experimental phase, enabling organisations to leverage AI-powered capabilities to boost revenue and productivity.

Fantastic Four Picks

We believe four stocks within the Magnificent Seven will continue to deliver leading ROIC as they further invest in customer-led innovation. Below I identify key catalysts for 2024 for each company. The percentage figures are our 2028 ROIC estimates.

AMAZON (21%)

- Unrivalled Fulfilment Network – Amazon’s transition to regional fulfilment has enabled the company to deliver more goods at faster delivery speeds and lower costs. Faster delivery speeds help Amazon maintain its position as the go-to online marketplace. Margins for the retail business will continue to improve, especially as excess capacity is efficiently used for Fulfilment-as-a-Service through newer initiatives such as Buy with Prime and Supply Chain by Amazon.

- Strategic Initiatives – Amazon has several growth initiatives that require significant capital expenditures few players can match but which can produce huge upside over the long term. These include the grocery and international stores business, Amazon Pharmacy for healthcare services and Project Kuiper for satellite broadband.

META (27%)

- Leading AI Compute Capacity – Meta will have a stockpile of almost 600,000 GPUs by the end of 2024. With its huge infrastructure capacity, Meta is looking to build state-of-the-art AI models that support its social and advertising platforms.

- Social Commerce Leader – Meta’s dominant platforms combined with unique data assets and market-leading AI algorithms optimise personalisation and improve conversion for creators and brands that are increasingly investing into social commerce, a market set to grow 30%+ annually over the next 5 years.

ALPHABET (30%)

- AI Prioritisation – Alphabet continues to restructure its workforce to prioritise AI investments. Internally, this improves operating efficiency. Externally, it accelerates the development and commercialisation of its AI capabilities, including its Gemini large language model, which is expected to surpass the current leading model, GPT4, from OpenAI.

- Search Dominance – According to Statcounter, Google had 91.6% of search share as of December 31 2023 despite worries of market share erosion from generative AI. Google will solidify its dominance by embedding AI capabilities in 2024. For example, Google recently launched Circle to Search, which enables Android users to use gestures like circling a handbag in an image and asking a question like “Where can I buy this?”

MICROSOFT (27%)

- Enterprise Demand Uptick – Microsoft is primed to spread the adoption of AI across its productivity and enterprise software installed base as more use cases roll out this year, built on a solid foundation with OpenAI’s market-leading models. At US$30 per Copilot license, each additional 1% adoption from its 365 customer base will add $1.4 billion to the top line.

- Azure Share Gains – Microsoft Azure is poised to gain share in the cloud computing market driven by its leading generative AI tech stack, sticky enterprise relationships and partnership with OpenAI. This new technological shift also presents an opportunity for Azure to gain share with developers and startups.

Look beyond potential risks

Addressing potential risks, the primary concern is a significant slowdown in consumer and enterprise activity, which could trigger a recession. Additionally, geopolitical risks are a factor to consider.

While uncertainties create short-term noise, Swell remains chartered on its course, investing in high-quality companies, long-term investment horizon and capital preservation.