The Magnificent Seven – how did they get here and where will they go?

Friday 21 July 2023

Portfolio insights

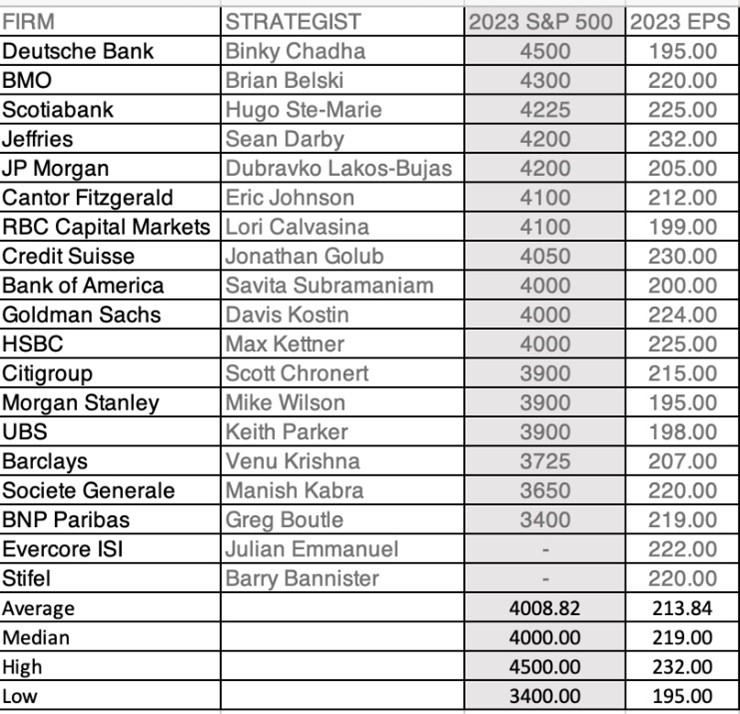

Since January 2023 the stock market has been surprisingly strong despite negative macro data points and sentiment heading into 2023. Consider the following forecasts made by investment bank market strategists at the start of the year.

The limited number of stocks leading the index higher is highly unusual. The “Magnificent Seven” have accounted for more than 95% of market gains, and they are, in order of market cap: Apple (+50%), Microsoft (+39%), Alphabet (+31%), Amazon (+50%), Nvidia (+196%), Tesla (+150%), and Meta Holdings (+139%).

This leads to the questions: Why just seven stocks? Is the increase justified?

Negative sentiment going into 2023

The market placed too much emphasis on the following overly negative narratives.

1. Recession in 2023

- The strongly inverted yield curve, one of the significant predictors of a recession.

- Leading economic indicators had been negative for several months.

2. Inflation

- Despite inflation declining from its peak in June 2022, wage inflation was stubbornly persistent.

- Employment numbers remained strong, and the unemployment rate gradually declined. While this is positive for the economy, market participants put a negative spin on labour statistics as they emphasised the inflation problem.

3. Higher rates for longer

- The Federal Reserve maintained its focus on taming inflation, and Fed Chair Powell continued to express the view of higher rates for longer.

In early March, the unfolding bank crisis caused a shift in the narrative.

Bank crisis – a turning point

The Fed’s persistent theme of tightening was challenged when three tech-oriented banks failed. It became clear further significant hikes in rates would bring major risks. Moreover, inflation continues to decline while the economy remains relatively resilient, with mild recession forecasts now pushed out to 2024.

The Magnificent Seven particularly benefited from the tempering of rate hike expectations, as they have characteristics that prosper in this environment.

- Quality as defined by low debt and strong free cash flow.

- Growth as defined by the ability to maintain and increase revenues and earnings even if the economy is not particularly strong or even in a recession.

- Lower rates in the future lower the opportunity cost/hurdle rate for discounting future earnings, leading to higher current valuations.

While the third point is a non-controllable, external and variable factor, certain companies can leverage their competitive advantages to maintain strong growth and free cash flows regardless of the macro environment. This is particularly so if those companies can lead the next productivity wave driven by modern AI technologies.

AI revolution – accelerating the turn

Generative AI, large language models and ChatGPT. These concepts, not even on the radar outside a small circle of AI researchers six months ago, are now globally recognised.

- Mentions of AI in corporate documents surged from 135,000 in 2020 to 715,000 last year.

- News articles mentioning AI have increased fivefold since the end of 2022.

- GlobalData estimates the global AI market will see 21% compound annual growth between now and 2030.

- Goldman Sachs predicts generative AI alone could drive 7% global GDP growth over the coming decade.

Hype or not, it is undeniable modern AI technologies have entered a new phase, one the general public, companies and market participants acknowledge. This results in actual usage, investment and research, driving advancements into the next decade.

While we cannot predict where the economy or the Magnificent Seven will be in three months or a year, Swell’s investment philosophy is to invest in high-quality companies delivering earnings growth that compounds over time.

The power of compounding

The power of compounding refers to the ability of an investment to generate additional returns on both the initial capital and the accumulated earnings. As earnings grow, the compounding effect becomes more pronounced, as the larger earnings base generates even more profits. Over time, this compounding effect can lead to significant wealth creation, as the growth in earnings is reinvested and compounds upon itself.

Let’s look at the power of compounding using the example of a company with a 10% compound annual growth rate (CAGR). Assume its earnings are $100.

- Year 1: earnings increase to $110

- Year 2: earnings increase to $121

- Year 5: earnings increase to $161

We hold four of the Magnificent Seven and believe they demonstrate the value of compound earnings, as their growth opportunities leveraging AI and machine learning (ML) are already apparent. The percentage figures below are our estimates of the CAGR of earnings per share (EPS) for each company over the five years from 2023 to 2028.

AMAZON – 44%

- Better retail segment margins driven by AI-enabled fulfilment improvements and advertising revenue growth

- Higher cloud computing revenue driven by AWS’s breadth and depth of existing AI and ML tools and proprietary hardware

META – 20%

- Better content creation tools and content recommendation engines drive deeper engagement

- Better AI-based advertising systems drive higher returns on ad spend for advertisers

ALPHABET – 14%

- AI-enhanced advertising systems drive higher returns on ad spend for advertisers

- Higher cloud computing revenue driven by leading research talent and capabilities, computing resources and proprietary hardware

MICROSOFT – 12%

- Higher sales of consumer and enterprise productivity products infused with AI capabilities

- Higher cloud computing revenue leveraging deep relationships with OpenAI and large enterprises customers

Rather than focusing on how ‘narrow’ the stock market surge has been, it is more important to focus on how ‘wide’ those companies’ opportunities and moats are.