Nvidia’s highly anticipated 2Q24 earnings

Thursday 12 September 2024

Investing insights

Key Highlights from the Earnings Report

Nvidia’s second quarter earnings report was one of the most highly anticipated in the quarter. Having recently surpassed Microsoft to become the world’s second-largest company by market value, Nvidia’s market capitalisation stood at $3.1 trillion when the results were announced, making it larger than the next 10 biggest chipmakers combined.

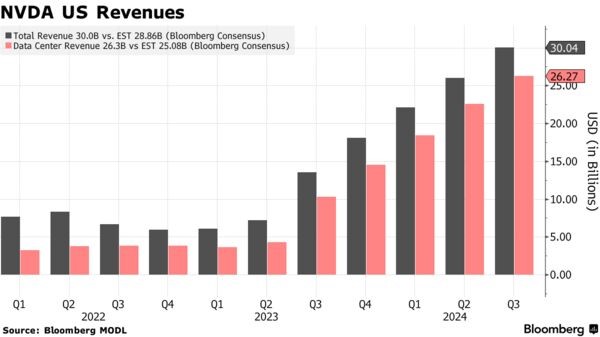

The company reported a strong quarter, driven by robust demand in the data centre segment. Second quarter revenue came in at $30.0 billion, growing 122% year over year, exceeding estimates of $28.86 billion. The data centre segment was particularly notable, with revenue reaching $26.3 billion, a 154% increase, well above expectations. Nvidia also announced a $50 billion share buyback program, signalling confidence in its future. Additionally, the company’s cash balance rose significantly to $34.8 billion, up from $25.98 billion six months earlier.

Why was the share price down in after-hours trade?

Despite the strong earnings, Nvidia’s shares fell by around 7% in after-hours trading, pulling down the broader market, with the Nasdaq 100 index also dipping by 1%.

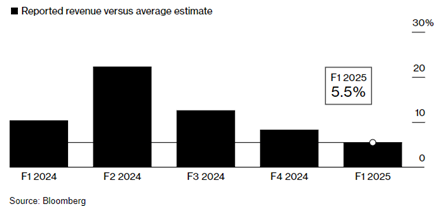

The dip can be attributed to sky-high expectations. While Nvidia beat revenue estimates, the margin of the beat was narrower than in previous quarters — 4.1% versus an average of 12.0% over the last six quarters. This slimmer beat disappointed some investors who had grown accustomed to more substantial outperformance.

Additionally, Nvidia’s sales projection for the upcoming quarter was roughly in line with analysts’ expectations, which failed to satisfy the most bullish investors. The company forecast third-quarter revenue of $32.5 billion, with some expecting an even higher outlook. This tempered guidance contributed to the after-hours slump.

Looking ahead, Nvidia faces challenges in scaling its sales growth. A key concern for investors was the delay in Nvidia’s new Blackwell design. The company admitted it had to make changes to the Blackwell GPU mask to improve production yield. CFO Colette Kress said the company expects to ship several billion dollars’ worth of Blackwell products in the fourth quarter and demand far exceeds supply, which will likely persist into next year. However, the lack of detailed guidance on this rollout disappointed analysts, contributing to the stock’s decline.

Outlook for Nvidia and Its Role in the AI Market

Has this earnings report changed the outlook for Nvidia and its role in the broader AI market? Not significantly. The same factors driving both the bull and bear cases remain as mentioned in my earlier analysis of Nvidia – Should you buy the dip on Nvidia?

Bull Case: Dominance in AI and Cloud GPU Markets

“NVIDIA achieved record revenues as global data centres are in full throttle to modernise the entire computing stack with accelerated computing and generative AI.”

Nvidia’s CEO Jensen Huang expressed continued optimism about the future of AI, emphasising the company is only at the beginning of a massive shift to re-equip the world’s data centres — a trillion dollar opportunity. Inference, rather than training, accounted for over 40% of data centre revenue, indicating that the early deployment phase of generative AI is underway.

While some have questioned whether production issues signal a crack in Nvidia’s dominance, AMD and Intel also traded down aftermarket, suggesting the market does not see them as immediate threats. Huang assured supply would improve each quarter, with significant improvements expected in 2025, reinforcing confidence in Nvidia’s long-term outlook.

Bear Case: Risks from Hyperscalers and Dependence on China

However, risks persist. As noted in my earlier article, retracement risk is high as Nvidia’s stock saw substantial appreciation in a short time, setting it up for difficult comparisons if growth slows compared to lofty expectations, as we are seeing now.

The latest earnings call highlighted that cloud service providers, or hyperscalers, accounted for about 45% of revenue. With these customers developing their own chips, Nvidia may need to diversify its customer base to reduce dependence on a few big players.

Additionally, while data centre revenue in China grew sequentially and was a significant contributor to overall revenue, it remains below levels seen before the imposition of export controls. The Chinese market, Kress noted, will remain highly competitive.

Buy, Hold, or Sell NVDA?

Given the pullback in Nvidia’s stock price after hours, the question for investors was whether to buy, hold, or sell. While the stock’s lofty valuation led to heightened expectations, the company’s fundamentals and long-term outlook appear intact. For those with a long-term horizon, Nvidia’s dominant position in the AI and cloud GPU markets, coupled with its strong growth potential, may still offer a compelling investment opportunity. However, the risks from high expectations, hyperscalers scaling their own chip production and dependence on the Chinese market are factors that should not be overlooked.