Reflections on Omaha

Wednesday 15 May 2024

Investing insights

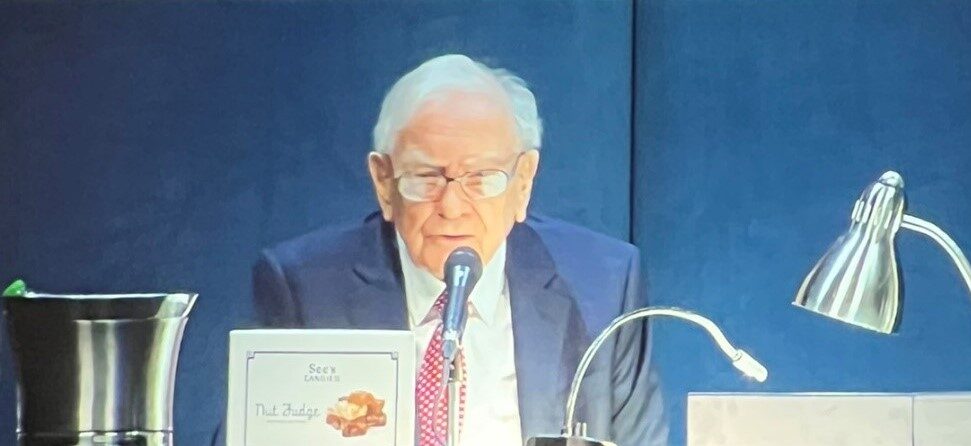

I attended the Berkshire Hathaway shareholder meeting in Omaha for the first time this year. Together with seminars by influential investors like Bill Ackman, Mohnish Pabrai and Bill Nygren, the trip confirmed the importance of our philosophy for value investing and gave me valuable insights into the keys to achieving success in the investment world.

The highlight was undoubtedly the chance to connect with fellow investors from across the globe, sharing stories and strategies that reinforced my understanding and passion for investing. Beyond the Berkshire Hathaway meeting and seminars, I also attended the Value Investors Conference and a dedicated seminar on the wisdom of Charlie Munger, which was particularly enlightening.

These are the value investing principles that resonated most strongly throughout my time in Omaha:

- Value over price: The distinction between price and value is fundamental, accentuating the importance of buying stocks that trade for less than their intrinsic value

- Circle of competence: Understanding and sticking to investments within one’s circle of competence should significantly reduce investment risks.

- Long-term orientation: Value investing is not about quick wins; it’s about the long-term appreciation of assets, focusing on sustainable returns over time.

- Margin of safety: Always investing with a margin of safety minimises potential downsides and provides a buffer against unforeseen adverse events.

- Market fluctuations: Using market volatility to your advantage, rather than succumbing to it, can deliver great buying opportunities.

- Independent thinking: The best investors regularly go against the crowd, making decisions based on analysis and conviction, not popular opinion.

- Quality companies: Investing in companies with strong histories of profitability and excellent management teams generally ensures reliability and stability.

- Simplicity is key: If an investment can’t be understood easily, it might not be worth the risk.

- Patience pays: The best returns often come from holding on to quality investments through market cycles.

- Continuous learning: The investment world is constantly evolving, and knowledge is critical to maintaining and enhancing investment acumen.

Reflecting on these principles with like-minded peers was not just a reaffirmation but also a deep dive into the practical application of these timeless investment philosophies. I came away with renewed confidence and a clearer understanding that investing is as much about character and discipline as it is about numbers and predictions.

Below is a picture of Warren Buffett’s home in Omaha, followed by a display of Tony Lama boots, part of the Justin Brands group owned by Berkshire Hathaway.