Investors beware: the fintech assault on big banks is coming

Thursday 18 February 2021

Portfolio insights

PayPal announced its strategy at its investor day last week and consumer banking is squarely in its sights. It has been a long journey for PayPal from a simple button on a website to a full suite of consumer products targeting the underbanked (individuals or families who have a bank account but often rely on alternative financial services) delivering its vision to democratise financial services to ensure every individual can thrive in the global economy.

PayPal’s expanding services

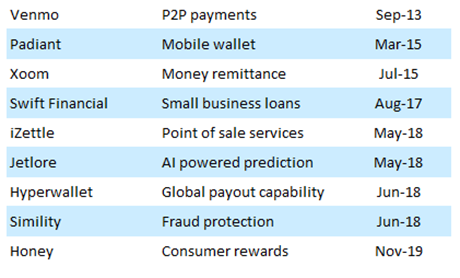

Over the years PayPal has expanded its offering through a combination of organic growth and acquisition. The acquisitions have been used to fill gaps in its product offering and include peer to peer payments (P2P), mobile wallet technology, money remittance, small business loans, point of sale services and more recently consumer rewards. A suite of smaller acquisitions enhanced its merchant services deepening PayPal’s relationship with retailers through AI powered prediction (Jetlore – May 2018), global payout capability (Hyperwallet – June 2018) and fraud protection (Simility – June 2018).

Consumer enhancements have featured strongly with One Touch purchasing, P2P payments, credit extension, crypto services and pay with QR codes powering growth. PayPal’s active accounts more than doubled from 181 million in 2015 to 377 million in 2020 while engagement has increased more than 1.5x. As PayPal rolls out these products and services globally, we expect user growth to expand meaningfully. PayPal’s management cite an addressable market of $110 trillion as the business expands from online retail, P2P / remittances and digital services into adjacent verticals of instore retail (QR codes), bill payments, in person services (savings accounts, cash withdrawal, cheque processing), business to consumer and emerging market payments.

The challenge to traditional banks

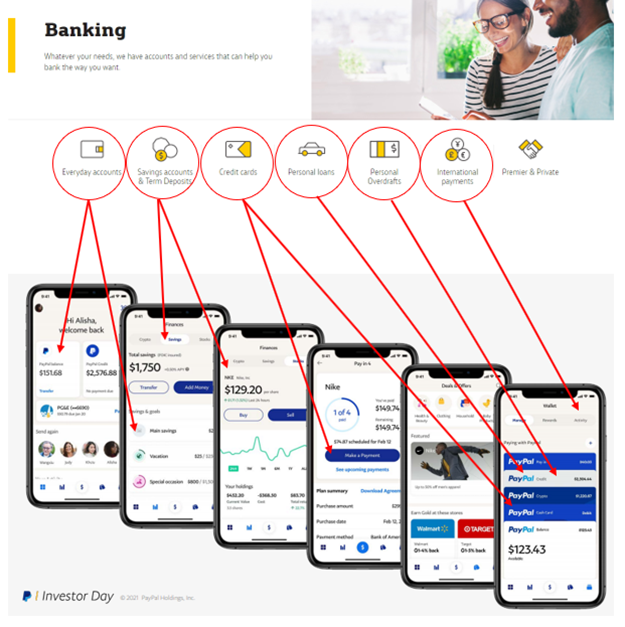

If these products sound familiar, you are probably using a main street bank. Below we cross reference a slide from PayPal’s 2021 Investor Day with CBA’s consumer offering. PayPal also provides unique services like the ability to receive and make payments in crypto (Bitcoin), low cost money remittance across borders and consumer rewards from within the PayPal wallet.

An interesting case study is the buy now pay later (BNPL) space where competitors are nibbling away at banks’ credit card monopolies. BNPL providers have been successful with a product that resonates with millennials leveraging insights and consumer data not available to traditional banks. This gives them lower losses, lower fraud and higher approval rates compared to traditional underwriting models.

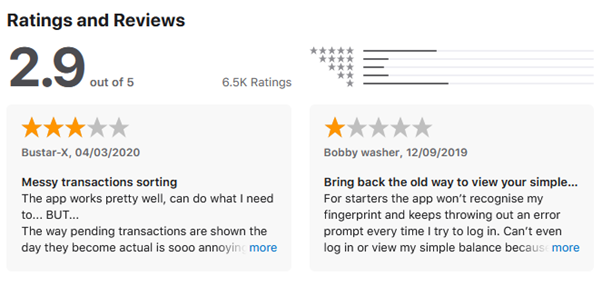

US BNPL company Affirm boasts more than one billion data points from 7.5 million loans over the last six years of repayments. Tellingly, consumers like these new providers, as you can see in their app store reviews: Afterpay 4.9 stars 397,000, Zip co. 4.9 stars 149,000.

On the other hand CBA’s 2.9 stars and 6,000 reviews reflect significantly lower customer satisfaction. The challenge to CBA and the traditional banks is highlighted in the app store reviews shown below. One user wants more innovation, the very next user wants less. The banks’ clients span a wide range of ages and technological prowess, a problem not encountered by fintechs with predominantly younger clientele.

The challenge facing traditional banks is the classic innovators dilemma. Disrupt large profitable products like credit cards and loans with competitive products to meet the new fintech competition or progressively cede market share while hanging onto legacy products. In addition, large legacy IT infrastructure reduces their ability to respond quickly to competition. For us, the future for traditional banks is not clear, accordingly, we will invest in the disruptor rather than the incumbent.