Mind the gap

Tuesday 21 March 2017

Investing insights

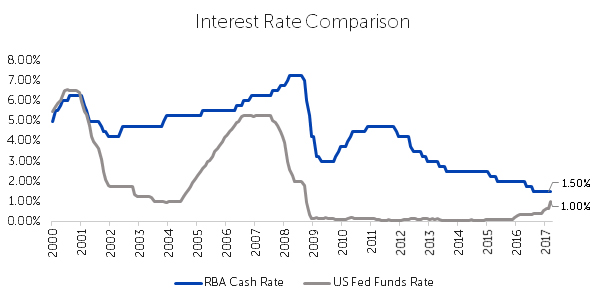

For the first time since 2001, US interest rates look to be closing the gap to Australian interest rates. This narrowing has implications for the Australian dollar. The AUD has been a beneficiary of this positive gap since 2001. A closing of the spread could significantly impact the AUD as the carry trade unwinds.

Furthermore, we are concerned about the housing market and the impact a correction could have on the Australian economy. Together these risks combine to influence our AUD-USD forecasts over the next few years.

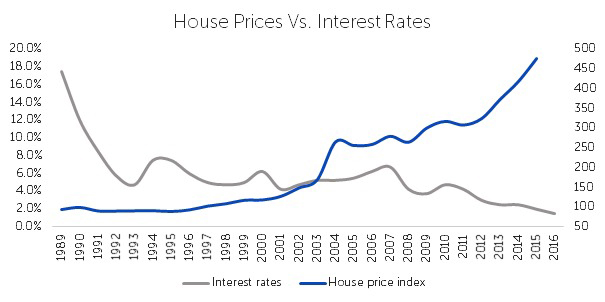

In the last 30 years, Australian interest rates have declined from 18% to 1.5% while Australian house prices have increased nearly 400%. House prices have a large impact on economic activity and how people feel i.e. the wealth effect. In the face of rapid house price growth, it is easy to forget Australian house prices are subject to the laws of gravity, like all asset classes.

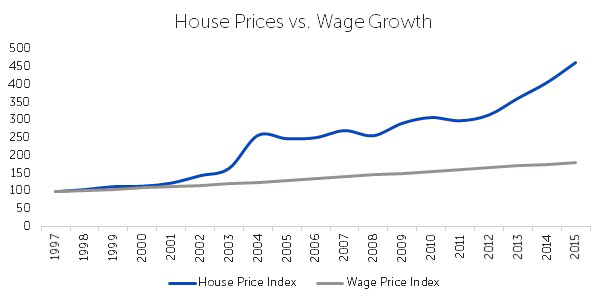

We are also concerned that house price growth has decoupled from wage growth, which obviously can not be sustained indefinitely. Wage growth would need to accelerate materially, and the opposite seems to be happening with current wage inflation numbers.

Internally, we expect to see the AUD-USD weaken materially as the interest rate differential between the US and Australia closes.

Interest rates will be the primary driver weakening the AUD-USD. Our internal estimates see the AUD-USD moving to 67 cents by December 2018. An Australian investor buying US currency at 77c today would achieve a 15% return on the currency by year end if that estimate is correct.

We believe the AUD-USD currency strength provides an opportunity for Australian investors to increase their weighting to high quality global investments.

Disclaimer:

The information provided in this document is of a general nature only, is not personal investment advice and has been prepared without taking into account your investment objectives, financial situation or particular needs (including financial and taxation issues). Investors should read and consider the investment in full and seek advice from their financial adviser or other professional adviser before deciding to invest.