Zillow: could strategic shifts and a user-centric focus move the share price?

Friday 08 March 2024

Portfolio insights

Our investment in Zillow has been one of our most disappointing, and if we thought we could effectively redeploy the proceeds into a better investment, we would do it immediately. We have stayed the course on Zillow because we believe in what management is doing, although the turnaround has taken longer to play out than we had expected.

At the Morgan Stanley Technology, Media and Telecom Conference this week Zillow’s CFO Jeremy Hofmann gave us some great insights. Together with the data shared at the investor presentation in February, we are optimistic about how the company is executing its strategy. Three particular areas of interest were Enhanced Markets, improving conversions from the sales funnel, and partnering with other industry operators.

Enhanced Markets driving revenue

Management spent 2022 and 2023 testing and refining product offerings, with particular focus on their nine enhanced markets in Denver, Phoenix, Atlanta, Raleigh, Charlotte, Durham, Las Vegas, Orlando and Riverside.

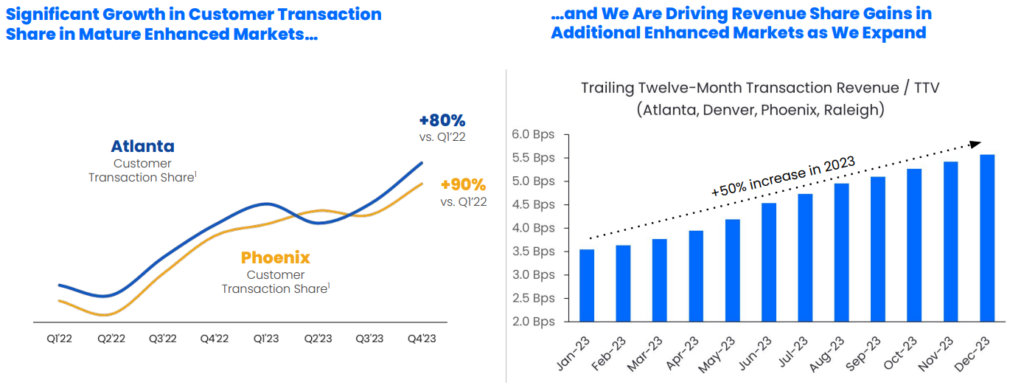

Enhanced markets feature the full suite of Zillow tools for agents, buyers and sellers, including real-time touring, integrated financing for buyers and seller solutions like Listing Showcase, the premier listing product for agents. Buyers and sellers are guided by Premier Agent partners and Zillow Home Loans loan officers, who help to simplify the complex process of buying and selling homes. The charts above show revenue per transaction increased by 50% in the oldest enhanced markets, which signals additional growth opportunities as enhanced markets are expanded this year.

2024 is the year of execution, with enhanced markets opening soon in Los Angeles, Portland, Sacramento and San Diego and another 36 major cities to be added by year end. This will account for 40% of the total US market.

Converting searches to transactions

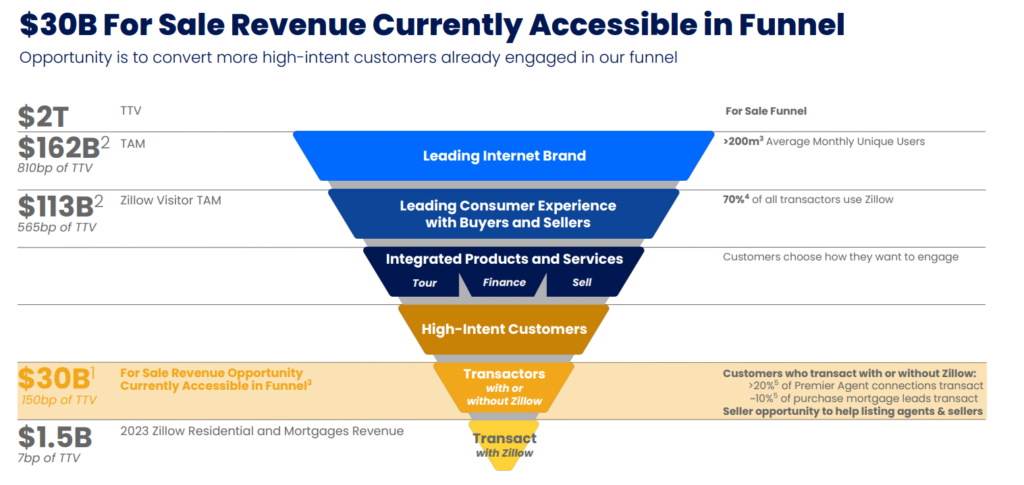

Zillow estimates the total addressable US real estate market is $2.3 trillion, $2 trillion from sales and $0.3 trillion from rentals. Its 2023 revenue was $1.9 billion, with $1.5 billion from sales and $0.4 billion from rentals, confirming the revenue projection is substantial. It recognises one of its greatest challenges is leakage from the sales funnel, with 80% of buyers starting their journey on Zillow but only 3% ultimately transacting through the platform.

Enhancements to Zillow’s housing super app are designed to reduce pain points for buyers and sellers, providing end to end transaction solutions to improve transaction closure. Real Time Touring is expanding to new markets and buyers and Premier Agents are incorporating Zillow Home Loans to push through buyer road blocks. Follow Up Boss provides greater capacity and support for agents to interact with buyers and sellers to complete transactions. And Listing Showcase, currently operating in 17 markets, should be nationwide by the end of the year.

Strategic partnerships

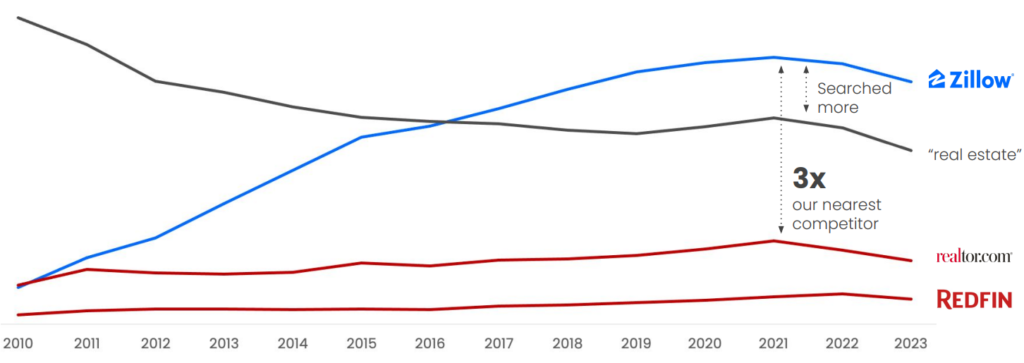

Zillow is the recognised real estate market leader in US internet searches as shown above. Its leadership is facilitated by partnerships with industry competitors which are win-win deals for both parties, but fundamentally serve to entrench Zillow’s competitive position at the top of the funnel.

This week it announced an agreement with Realtor.com to make Zillow the exclusive provider of multifamily rental listings on Realtor.com, generating additional exposure for listings to millions of renters.

Zillow’s new-construction listings are automatically syndicated to Redfin, connecting home builders with buyers on both platforms. The partnership expands the reach of home builder listings on Zillow and allows Redfin customers to search a broader range of new-construction homes for sale.

A partnership with OpenDoor enables sellers on Zillow’s platform to simultaneously request a cash offer from OpenDoor and an estimate from a local Zillow Premier Agent partner for what their home could sell for on the open market. The service is available in select markets.

Ahead

These developments give us confidence solid revenue growth will begin to be reflected in the share price. Higher US interest rates have driven housing affordability to record lows, but tough times don’t last forever and the mortgage market is showing its first green shoots. We believe Zillow remains materially underappreciated and is poised to recover as the mortgage environment improves and the business succeeds in executing its technology and market strategy.