3 key takeaways from the first FAANG earnings result

Friday 28 July 2023

Portfolio insights

Netflix reported second-quarter earnings results on July 20 at 0800 AEST. The stock was down 8% post-earnings but up 48% year to date. Was the decline warranted?

Let’s walk through 3 key elements from the results and explore the implications for investors.

- Subscriber growth boosted by password-sharing crackdown

- Advertising-tier unlocks future growth for the patient investor

- Netflix will continue to dominate the growing streaming market

Subscriber growth boosted by password-sharing crackdown

Netflix significantly outperformed Wall Street expectations by adding 5.9 million new paid subscribers, solidifying its position as the leader in subscription-based video streaming with 238 million global paid memberships. The company also guided to a similar level of subscriber net additions for the third quarter, also above expectations.

As noted in a recent Livewire article Netflix Earnings Preview: Unlocking Growth and Shaping the Future of Streaming, subscriber growth was a key consideration for this earnings result given Netflix’s “dual strategy to revive growth by introducing a new ad-supported tier and cracking down on password sharing”.

This quarter’s results demonstrated early success in tackling password-sharing. Here’s what the company said:

- Expanded paid sharing to 100+ countries which accounts for 80% of revenue in May

- Low cancel rates and healthy conversion of borrowed accounts into full-paying memberships

- Positive impact on revenue and paid memberships across all regions

- Plan to expand the policy to nearly all operational countries

As CFO Spencer Neuman noted during the earnings call:

“most of our revenue growth this year is from growth in volume through new paid memberships and that’s largely driven by our paid sharing rollout.”

Despite the outperformance in subscriber additions, second-quarter revenue of $8.19 billion was slightly below market expectations of $8.29 billion.

The revenue miss resulted from a decrease in average revenue per member, which is down 3% year over year. The decline was due to limited price increases over the past year and the timing of paid net subscriber additions due to the paid sharing rollout in May and a higher proportion of membership growth stemming from countries with lower subscription pricing.

Although these factors limited revenue growth in this quarter, I believe they further confirm the investment case for Netflix for long-term investors.

In the current environment of declining cable TV subscribers, soft advertising demand and higher costs, competitors are increasing subscription prices as they struggle to reach streaming profitability. Netflix stands out as the only streaming service that continues to strategically price its service to maintain profitability while also attracting subscribers globally. This approach fuels Netflix’s growth cycle, as it begins with an increasing user base that allows the company to make data-driven content investments, leading to higher profits and expanded content investment capabilities.

Advertising-tier unlocks future growth for the patient investor

Netflix’s foray into advertising is showing promising signs. Here’s what the company has shared:

- Ad-supported tier membership has almost doubled since Q1

- Advertising revenue is not yet material but is poised to become a multi-billion-dollar incremental revenue stream in the future

- Netflix is actively working on enhancing verification and measurement capabilities, with plans to establish ad sales teams globally

As discussed previously Netflix has the potential to capture a larger share of advertising budgets. Its exceptional content library, wide reach, and impressive engagement metrics give it a competitive advantage. In the near term, its focus on improving advertiser tools will catalyse advertising revenue growth. Over time, its commitment to delivering an exceptional user experience opens doors for innovative advertising opportunities blending premium content with personalisation.

While the impact of paid sharing and advertising will take time to fully materialise, Netflix is strategically phasing in this initiative to drive long-term revenue growth. With advanced technology and data capabilities, Netflix is well-positioned to optimise its offerings and attract new subscribers.

Netflix will continue to dominate the growing streaming market

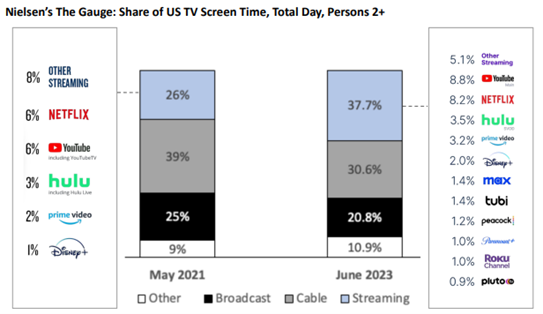

Finally, consider Netflix’s industry position using Nielsen’s data which tracks the share of TV screen time in the US.

Two takeaways from the chart are:

- The overall share for streaming has increased significantly over the past two years as linear TV viewership continues its structural decline

- Despite increased competition for viewers, Netflix has increased its share of streaming to 8.2% from 6% in 2021

I believe these two trends will endure over the next decade, with streaming share of overall TV time increasing and Netflix’s share of streaming increasing. Netflix’s strong execution and focus, strength in both entertainment and technology, and new initiatives will help ensure its lead in terms of engagement, revenue and profit over the long term.

The stock’s current valuation is reasonable considering future growth prospects. Netflix continues to be a part of the Swell Global Portfolio.