Meta investing for sustained growth

Thursday 25 August 2022

Portfolio insights

3 key takeouts:

The pandemic accelerated structural changes that will continue to drive social advertising growth over the long term

Changes to privacy regulations are reducing opportunities for smaller players to identify and target customers

Meta is investing in infrastructure and technology to optimise advertisers spend

Introduction

Despite clear structural tailwinds behind mobile and social advertising revenue growth, media headlines suggest Meta is facing macro headwinds and increasing competition from TikTok. Much of the hype is based on short-term earnings results. We believe investors should consider a more important factor behind slowing revenue growth at Meta, Apple’s App Tracking Transparency (ATT) policy changes.

Here we consider key developments in social advertising and ATT changes and outline why we believe Meta will accelerate revenue growth over the long term.

Social advertising 2000 – 2020

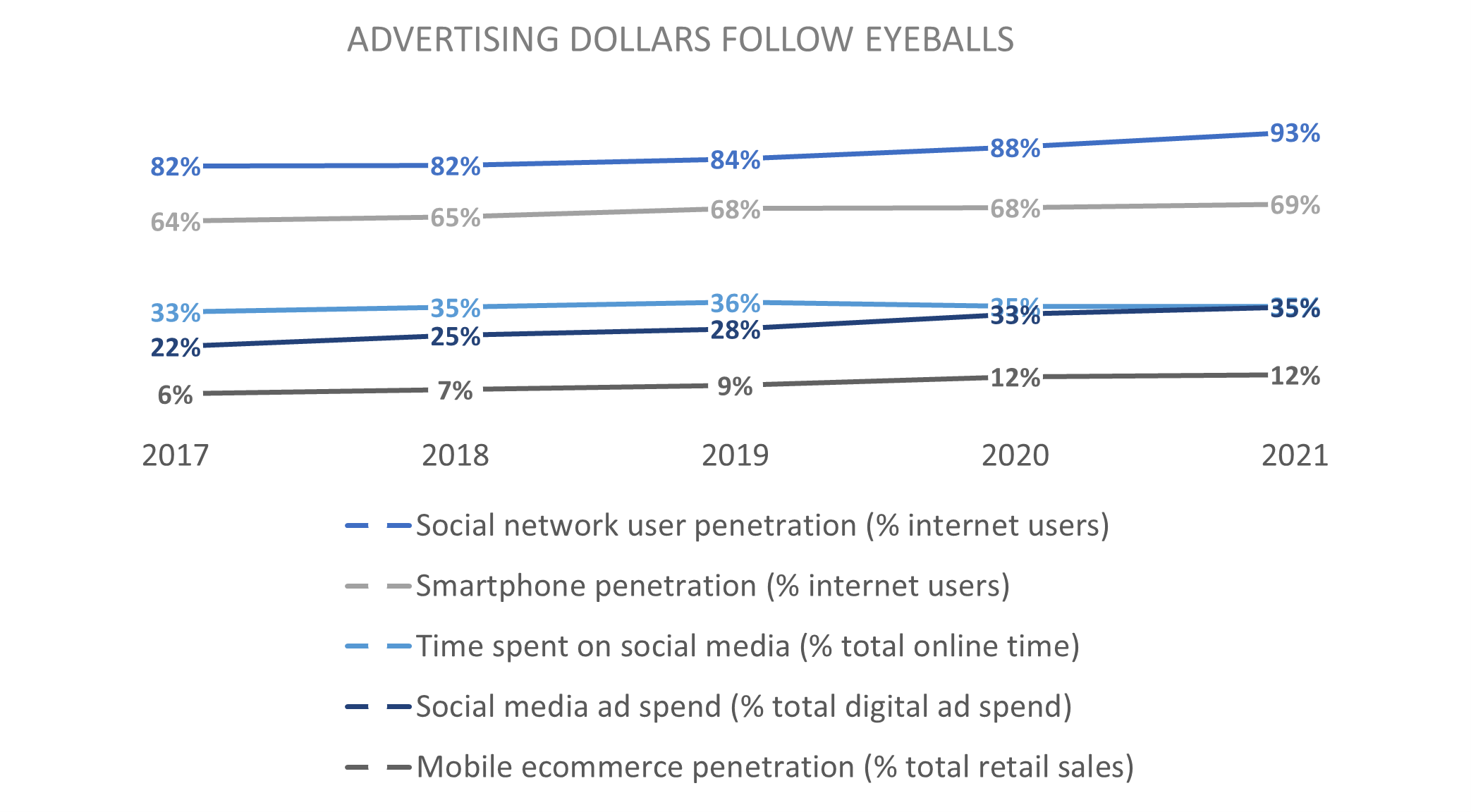

A golden rule of advertising is that “money follow eyeballs”. Mobile advertising evolved from the first mobile ad shared via SMS in 2000. The release of Apple’s first iPhone in 2007 paved the way for in-app ads from 2014. Growth in the mobile app ecosystem along with advances in 3G and 4G connectivity drove an increase in the share of internet usage on mobile devices.

This culminated in mobile overtaking desktop devices in 2016, and by 2017 the world had orientated to mobile first. Social media platforms became the primary way internet users engaged with their friends, family, community and interests.

Interestingly, social media advertising spend lagged usage penetration significantly prior to 2020 and reached parity in 2021. Closing the gap coincided with the expansion of ecommerce, particularly on mobile devices. Pandemic accelerated structural changes will continue to drive social advertising growth over the long term, in our view.

Social advertising 2020-2021

Enforced movement restrictions triggered striking increases in digital media use and the adoption of omnichannel commerce. Of necessity, businesses invested in new technology, infrastructure and advertising to meet consumer needs. In 2021, digital advertising formats grew by 31% to reach $442 billion or 146% of the pre pandemic market size. Social advertising grew 34% as its ability to reach engaged users over traditional means became clearer.

With the easing of movement restrictions in 2022, the mobile advertising industry has experienced a slowdown. Meta, the biggest player in mobile and social advertising, posted its first-ever yearly revenue decline of 1% for the second quarter, and a key contributing factor was ATT which upended the mobile advertising industry.

IDFA and ATT

Apple introduced its ATT policy as part of the iOS 14.5 rollout in April 2021. The policy required app publishers to collect opt-ins from iOS users to access the phone’s unique Identifier for Advertisers (IDFA). IDFA was the primary means by which iOS advertising campaigns were measured and optimised by app developers.

The impact on Facebook was particularly evident. Its advertising platform was perfectly tuned so advertisers could run cost-efficient campaigns optimised for return on ad spend (ROAS). For small business advertisers, ROAS determines real-time ad budgets.

Advertisers lost the ability to measure and inform their ad buying model about the relevancy of users, their economic profile and the composition of traffic. They could no longer use previous conversion data to predict and capture the high value users who were likely to buy their product.

Digital advertising expert Eric Seufert had estimated the impact on Facebook would be a 7% revenue headwind in the worst case, but believes it was ultimately 12-15%. You might wonder, how has Meta not developed viable workarounds? The primary limitation has been Apple’s new measurement framework, SKAdNetwork. It significantly limits the ability to attribute conversions.

Apple’s SKAdNetwork

Put simply, the inadequate measurement framework essentially created what Seufert describes as a chicken-and-egg problem for advertisers. He said “campaigns lack the conversion values required to calculate ROI because they are low scale, but the campaigns can’t be scaled because ROI can’t be calculated”.

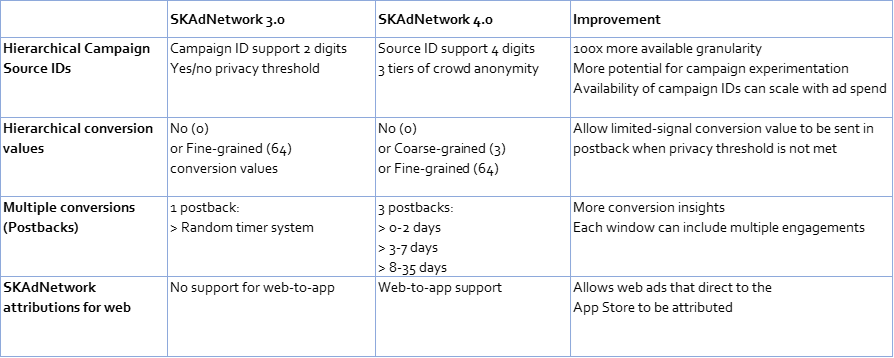

Apple announced at WWDC in June it had updated the SKAdNetwork with a new version to be released later this year. Presumably, the decision was driven by the realisation the framework resulted in damaging consequences. The table below provides an overview of the key improvements.

In essence, Apple seems to have moderated its approach to privacy standards. In doing so it has transferred some power back to players of greater scale and sophistication. With SKAdNetwork 4.0, larger ad platforms with more computing capability and capacity will be able to capture more value from the expanded pool of data.

The privacy-first approach to advertising is industry-wide. Google is removing third-party cookies. It has also flagged it will suppress availability of advertising IDs on Android phones (GAIDs). In addition, privacy-related legislation and regulations will add to the complexity of navigating the market, making it harder for smaller publishers to execute. Privacy-first reassigns power to walled gardens as businesses must integrate with scaled platforms to reach the target audience in privacy-safe ways.

Social advertising dynamics

According to Zenith, social ad spend is forecast to grow at an average rate of 15% a year between 2021 and 2024. We believe social ad spend could grow at a higher rate propelled by three underlying structural dynamics:

- Privacy-first standards underpinned by media inflation

Brands must aggregate first-party data and anonymised third-party data to reach the best prospects in the most efficient channels. They will need to leverage innovative ad tools, AI-driven ad formats, and immersive augmented reality experiences. - The digital economy underpinned by omni-channel commerce

Advertising on social channels will be increasingly important within the marketing mix. US retail ecommerce sales will top $1 trillion for the first time this year. eMarketer estimates 40% of US ecommerce sales will take place on mobile devices. - Discovery-driven content consumption underpinned by fragmentation of user attention

Platforms with the most creators and the best creator tools will be able to aggregate engaged audiences with diverse interests.

Meta’s priorities

A look at Meta’s investment priorities reveals why it is poised to benefit from these structural dynamics. In recent earnings calls Meta has highlighted three investment priorities:

- Reels – “AI not just as a recommendation system but as a discovery engine that can show all of the most interesting content that people have shared across our systems”

- Ads – “AI investments to drive better recommendations for people and higher returns for advertisers”

- Metaverse – “enable deeper social experiences”

The common technology underpinning it all is AI. And Meta is widening its deep moat in AI through investments in servers, data centres and AI.

Meta investments

Meta was the fourth largest CAPEX spender in the S&P 500 in 2021, behind Amazon, Alphabet and Microsoft. Its nearest listed social media competitor, Twitter, is expected to spend less than $1 billion in 2022. Therefore, not counting accumulated advantage over the past decade, Meta will have a 30x infrastructure advantage over Twitter just this year.

In addition, Meta operates its own data centres with proprietary hardware, delivering cost benefits and greater agility. In contrast, Snapchat is dependent on Google Cloud and Amazon Web Services. This is a huge line item within cost of revenue. Even more so as the industry moves to AI- and AR-driven user experiences and ad formats. Recently, TikTok confirmed it is using Oracle Cloud infrastructure to store and audit US user data.

Mark Zuckerberg and Chief Product Officer Chris Cox plan to increase the number of GPUs in Meta’s data centres fivefold by year end. Earlier this year, Meta introduced its cutting-edge supercomputer for AI research, the AI Research SuperCluster (RSC). It will be the world’s fastest when completed later this year. Mark Zuckerberg commented in a Facebook post

“The experiences we’re building for the metaverse require enormous compute power (quintillions of operations / second!) and RSC will enable new AI models that can learn from trillions of examples, understand hundreds of languages, and more.”

AI advantage

AI advances will power the next generation of user, creator and advertiser experiences within Meta’s ecosystem. Although it is still early days, results thus far demonstrate Meta is well positioned to capture a significant portion of the evolving privacy dominated social advertising market.

- Reels engagement is growing quickly – it accounted for 20% of the time people spent on Instagram in the first quarter and Meta saw a more than 30% increase in the time people spent engaging with Reels across Facebook and Instagram in the second quarter.

- Driving closer integration with commerce by facilitating interactions between brands and consumers – Click to Messaging ads is one of Meta’s fastest-growing ad formats, and is a multibillion-dollar business growing at double digits.

- Pivot to discovery engine of all content – approximately 15% of content on Facebook and slightly more on Instagram is recommended by Meta’s AI from outside a user’s social graph and is expected to more than double by the end of 2023.

- Price per ad is decreasing and impressions are increasing – a big positive as it indicates increasing ad inventory and attractive ROAS opportunities for advertisers. Facebook experienced its second biggest stock price drop after introducing Stories when the same dynamic was playing out. While the market viewed it as a negative, it ultimately set up multiple years of growth.

Conclusion

We believe the market is heavily discounting Meta’s share price based on short-term headwinds. This provides the perfect opportunity for long-term investors like Swell to navigate through the noise, understanding its fundamental valuation drivers and growth opportunities.