Deere’s road base

Monday 12 April 2021

Portfolio insights

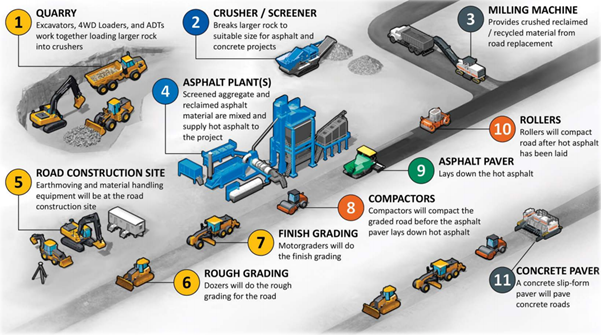

Deere & Co acquired German based global road construction business Wirtgen in 2017. The strategic rationale for the acquisition was to extend Deere’s exposure to transportation infrastructure, which is a faster growing and less cyclical sector than the broader construction industry.

As a global leader in road construction equipment, Wirtgen was expected to enhance Deere’s positioning with key customers and the broader industry through complementary product lines and a large global presence, particularly in Germany, Italy, China and Brazil. With Wirtgen, Deere’s portfolio is involved at every step of the road construction value-chain.

Post-COVID growth tailwinds

The transportation sector accounted for 17% of the $9.5 trillion in global construction spending in 2015 according to an IHS Global Insight report, and this figure is expected to increase to 19% by 2030 through megatrend drivers including rapid urbanisation, rising global incomes and capital investment, particularly in Asia. Governments seeking to stimulate economic development post pandemic will likely amplify the trends.

The US market accounts for approximately half of Deere’s global construction revenue, and we believe the integration of the Wirtgen range into Deere’s portfolio offers a powerful use case for cost-effective stimulus projects.

The American Jobs Plan

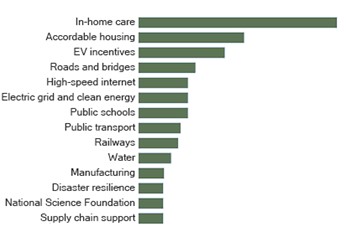

The Plan is a US$2 trillion economic stimulus package that seeks to upgrade the country’s ailing infrastructure while addressing issues such as racial and wealth inequality, mitigating climate change impacts, extending the availability of high-speed internet services and providing better access to affordable housing. Funds are to be allocated to the following key areas:

- $621 billion to upgrade and improve the resilience of transportation systems including bridges, roads, rail, airports, ports and electric vehicle development

- $400 billion for programs to improve care for the elderly and disabled

- $300 billion to retrofit and build affordable housing and schools

- $580 billion allocated to American manufacturing initiatives, R&D and job training

The full target range of the plan is shown below

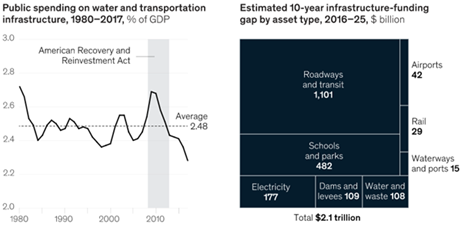

Although the US is among the wealthiest countries in the world, it was ranked it 13th in the quality and reliability of its infrastructure in the World Economic Forum’s (WEF) global competitiveness report last year. In fact, the American Society of Civil Engineers (ASCE) estimated the US had an unfunded infrastructure gap of more than $2 trillion in 2016. In its recent 2021 infrastructure report card, ASCE estimated that figure had ballooned to around $2.6 trillion.

Green roads

Deere’s industry leading technology provides a road building solution which also aligns with President Biden’s objective to reduce the impacts of climate change during his term. Deere’s smart industrial strategy, announced last year, is designed to accelerate the pace at which it delivers intelligent solutions to users through an intuitive technology stack made up of hardware, embedded software, connectivity, data platforms and applications.

Together with Deere’s end to end road construction capacity, the company’s leading-edge technology should increase its opportunities to contribute to the stimulus projects.