The end of the internet cookie

Wednesday 10 March 2021

Portfolio insights

Google recently confirmed it will stop selling ads based on user-tracking browser data – a big announcement with significant implications for those working in the online advertising industry. Historically, most online advertising platforms relied heavily on gathering data about consumers through their browsing habits – more data creates better user profiles which enables advertisers to improve ad targeting which then increases their return on advertising spend. Third-party cookies were the tool of choice to gather this data.

To be sure, the company announced last year that it would remove support for third-party cookies by 2022, but the most recent statement puts a clear line in the sand with regard to online tracking and user privacy using Google properties moving forward. Google’s Director of Product Management (Ads, Privacy and Trust), David Temkin, made this clear in a recent blog post.

“We’re making explicit that once third-party cookies are phased out, we will not build alternate identifiers to track individuals as they browse across the web, nor will we use them in our products.”

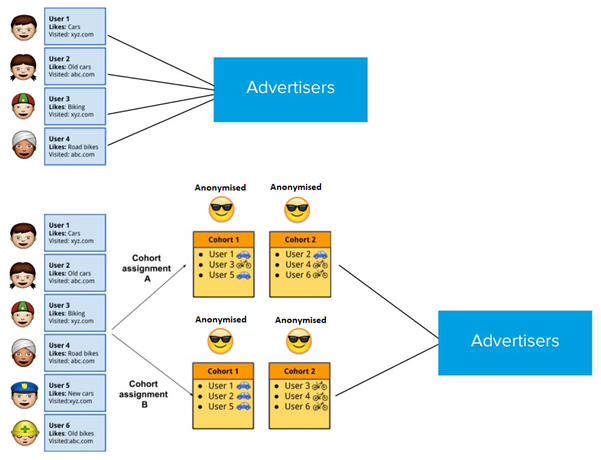

Temkin acknowledged other platforms may continue to offer their own variants of ad-tracking across the web, but said “we don’t believe these solutions will meet rising consumer expectations for privacy, nor will they stand up to rapidly evolving regulatory restrictions, and therefore aren’t a sustainable long-term investment.” Instead, Google has developed a new methodology to profile internet users that places them into cohorts based on similar interests, demographics and other factors, which advertisers can then use for ad targeting.

Google commands over 90% of the global online search market and has vast amounts of data to access via its Search, Maps and YouTube businesses. For context, its search engine reportedly conducts over 5 billion search queries per day and over 1 billion videos are viewed every day on YouTube. The company has accumulated incredible amounts of data on its users over many years, who receive significant benefits from Google’s platforms at no financial cost. Few other online advertising platforms can replicate its scale of first-party data on consumers.

We believe this is a win-win for Google – increasing user privacy and entrenching the value of its advertising business. The new policy may have a small impact on non-Google advertising properties, which account for less than 13% of its revenue and will likely continue their decline as a proportion of its total revenue. The relative gap between the company and smaller peers just widened – as did its moat.

Although this was a voluntary move by Google, changes in the regulatory environment around data use and user privacy are obviously on the horizon. However it is increasingly clear more stringent regulation favours incumbents.

DISCLAIMER

This document has been prepared without consideration of any specific clients investment objectives, financial situation or needs. While this document is based on information from sources which are considered reliable, Swell Asset Management, its directors and employees do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or accurate. Any views expressed are taken to be those of the individual sender, except where the sender specifically attributes those views to Swell Asset Management and is authorised to do so. Swell Asset Management is an authorised representative of Hughes Funds Management Pty Limited ACN 167 950 236 AFSL 460572.