Apple profits at risk from DoJ antitrust case

Tuesday 09 February 2021

Portfolio insights

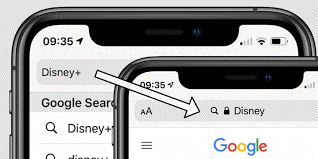

When the US Department of Justice (DoJ) brought its antitrust case against Google in October 2020, it flagged the large payment made to Apple for positioning it as the default search engine in Apple’s Safari browser.

Most significantly, Google has had a series of search distribution agreements with Apple, effectively locking up one of the most significant distribution channels for general search engines.

US Department of Justice in its antitrust filing against Google 2020

The DoJ estimates the payment is valued between $8 and $12 billion.

We believe the outcome of the DoJ antitrust case has more serious implications for Apple than for Google. The Google payment goes directly to Apple’s bottom line, with no overhead. The company reported profit of $57 billion in 2020, making Google’s contribution around 20%, a hefty loss to bear.

If the court finds the payment should be prohibited, Google’s costs would decline. The ban could expose Google to increased competition. However, it is likely most Safari users would select Google as their default search engine, causing minimal impact on Google’s user base. Moreover, Google’s operating margin for search is about 30%, so it would need to lose between $33 and $47 billion in revenue before its bottom line was hit.

While we recognise Apple is a fantastic business, we don’t believe the current downside risks are fully reflected in its share price. This was part of the reason we sold our Apple position last month and retain Alphabet as one of our largest positions in the Portfolio.