The coronavirus pandemic has created an unprecedented global disruption, and like everyone else, we have little idea when the crisis will subside and lives can return to normality. In these times, it is more important than ever that we stick to our investment process and philosophy and concentrate on the things we can know, rather than speculating about unknowns. Our investment team have used the last weeks confined to our homes to ensure we stay ahead of the curve in understanding the future of the businesses we hold and identifying the most informed estimates of the way forward.

Four phases to recovery

We were impressed with the framework provided by Mastercard CEO, Ajay Banga during the company’s Q1 earnings call last week. He sees the recovery moving through four phases:

- Containment

- Stabilisation

- Normalisation

- Growth

His assessment is that we have moved through the containment phase, characterised by a rapid contraction in global economies, and are now in the stabilisation phase. Around the world people are learning to live with restrictions and constrain their spending on non-essential items, while occasionally indulging on treats, more often than not through an e-commerce platform. Businesses have retooled factories, remodelled working conditions and taken whatever steps best support their operations.

Mr Banga sees the normalisation phase, which we move to next, as a gradual opening up of markets, supported by improved testing and tracing technologies as well as more efficacious drug therapies, despite the lack of an effective vaccine. He does not expect the positive impact to be uniform, but rather limited to sectors which have “pent up demand”. He told investors “It’s possible that we will see early signs of normalisation in some sectors and geographies throughout the rest of this year.”

Finally, he predicts the growth phase will follow the widespread availability of a vaccine or proven therapy to treat the virus. Notably, the transformation will not be linear and the likely duration of each phase is unknown. The critical factor for Mastercard is the framework it provides for organisational and business planning.

Adopting a framework

Our approach to investing since the pandemic arrived has not changed. Our assessment of the long term growth drivers impacting portfolio companies is critical in our analysis of their value and we believe quality companies will benefit from tail winds which have the capacity to defy economic shocks. This appraisal reflects the framework, noting a company’s performance through the four phases will be linked to its fundamental business drivers.

The containment phase exposed a huge disparity between companies that will benefit and those that will be left behind. More than ever, this is a stock pickers market. Most of our portfolio companies have reported their March quarter earnings, and we remain confident their plans for future management of their operations are sound and their growth drivers will support them.

One dominant trend obvious in the results was an acceleration of the shift toward digitisation. For example, Amazon, Alibaba, Alphabet, Microsoft and Tencent saw their revenue surge as companies and consumers sought to adjust to life in lockdown during the stabilisation phase.

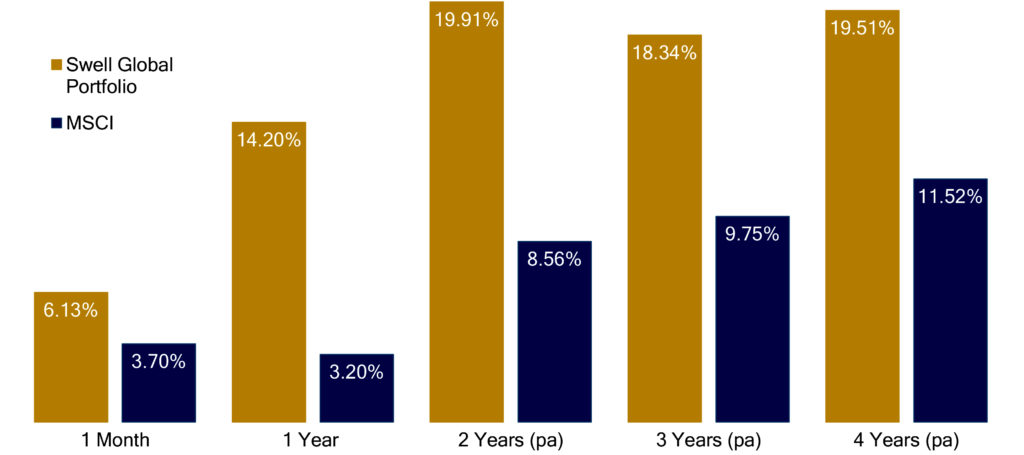

We firmly believe our portfolio investments are best positioned to emerge from this pandemic stronger, and we are excited about the future of the Swell Global Portfolio, which marks its fifth full year since inception next month.

We’re just getting started . . .

Subscribe to our updates |