The Digitisation of Everything – Payments

Thursday 06 February 2020

Digitisation

Payments was one of the first industry sectors to undergo digitisation. Now the Internet of Things (IoT) is enabling multiple ways to pay, 5G is facilitating faster, more reliable payments and AI is helping detect and remove security threats.

Our technology accelerators are helping institutions provide the new and seamless services required by their customers.

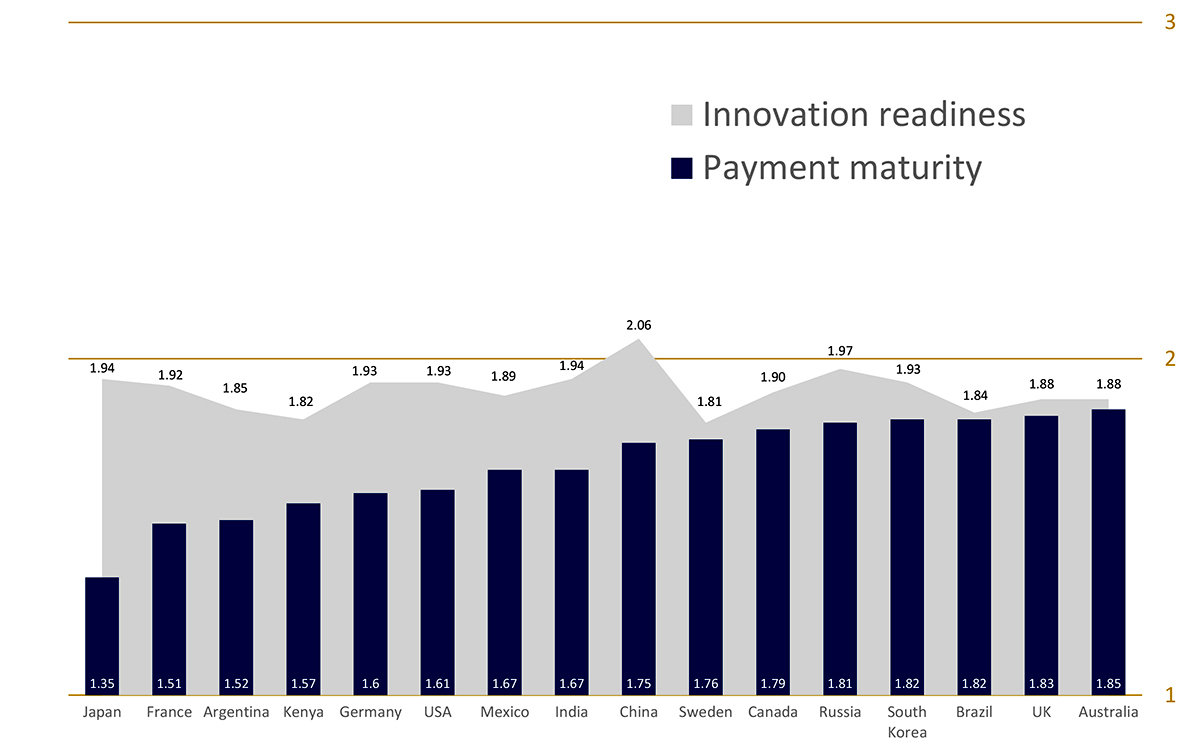

Visa describes the highest level of maturity of a payment system as the point where payments are seamlessly integrated across platforms and experiences.

Imagine an intelligent camera system that recognises your car allowing you to pay for petrol without going into the checkout, or biometric sensors that allow you to pay for an ice cream at the beach using fingerprint or face recognition. These are examples of a level 3 fully integrated payments system. Currently as you can see in the graph below, most developed countries sit somewhere between level 1 and 2, but our technology accelerators are facilitating the move towards the level 3 end state.

IoT is one of the core accelerators driving us towards level 3 as it will provide multiple ‘ways to pay’ allowing consumers to pick whatever method suits their needs best. The Bond Internet Trends Report for 2019 shows most digital transactions today are already spread across many different payment methods including buy buttons, in-app payments, P2P transfers, messaging apps, QR codes, smart devices and wearables.

As new payment methodologies emerge they will only become mainstream if they can be reliably and securely integrated into the ecosystem and provide a better solution than existing methods.

5G technology will enable billions of smart payment devices to connect to payment networks in a fast and reliable manner, with latency being the key dynamic. Latency, the time it takes a device to send data to a remote server and receive a response, is expected to be less than 1 millisecond with 5G compared to over 50 milliseconds for 4G.

This will enable the number of IoT devices capable of payments to grow exponentially.

- Companies processing payments including PayPal, Mastercard and Alibaba’s Ant Financial will see increased transaction volume and growth in processing revenues

- Traditional financial institutions such as Bank of America and JP Morgan will see greater opportunities to offer value added services to their banking customers

- Technology companies like Apple, Google, Facebook and Amazon will see increased sales of connected devices and take up of their own payment services like Apple Pay and Android Pay

When it comes to transaction security, AI will be the key technology accelerator. With the growing complexity and sophistication of fraudulent attacks, AI is increasingly being used by financial institutions in place of rules-based logic, to combat security threats. Machine learning is ideally suited to detecting payments fraud because it can analyse large amounts of data and improve over time.

Visa is at a distinct advantage when it comes to AI due to the immense amount of data at its disposal. With over 3 billion accounts and more than 180 billion transactions annually Visa’s AI can detect and prevent fraudulent transactions before they occur. This year Visa’s AI has saved its customers over $25 billion by preventing fraudulent transactions.