Amazon reaches for the stars

Monday 29 July 2019

Portfolio insights

Jeff Bezos is proving the sky’s no longer the limit for Amazon as it plans to launch thousands of toaster sized satellites to provide broadband to the world. Some analysts speculate the project could increase Amazon’s valuation by over US$100 billion. Initially the focus will be providing internet access in developing countries.

Project Kuiper

In Amazon’s own words:

“Project Kuiper is a long-term initiative to launch a constellation of Low Earth Orbit satellites that will provide low-latency, high-speed broadband connectivity to unserved and underserved communities around the world.”

Network of satellites

The initial proposal is to launch a network of 3,236 satellites at a cost estimated to be in the billions of dollars. At the recent Amazon re:MARS 2019 conference in Las Vegas, Jeff Bezos commented:

“It’s a very good business for Amazon because it’s a very high capital expenditure undertaking. It’s multiple billions of dollars… Amazon is a large enough company now that we need to do things that, if they work, can actually move the needle.”

Market opportunity

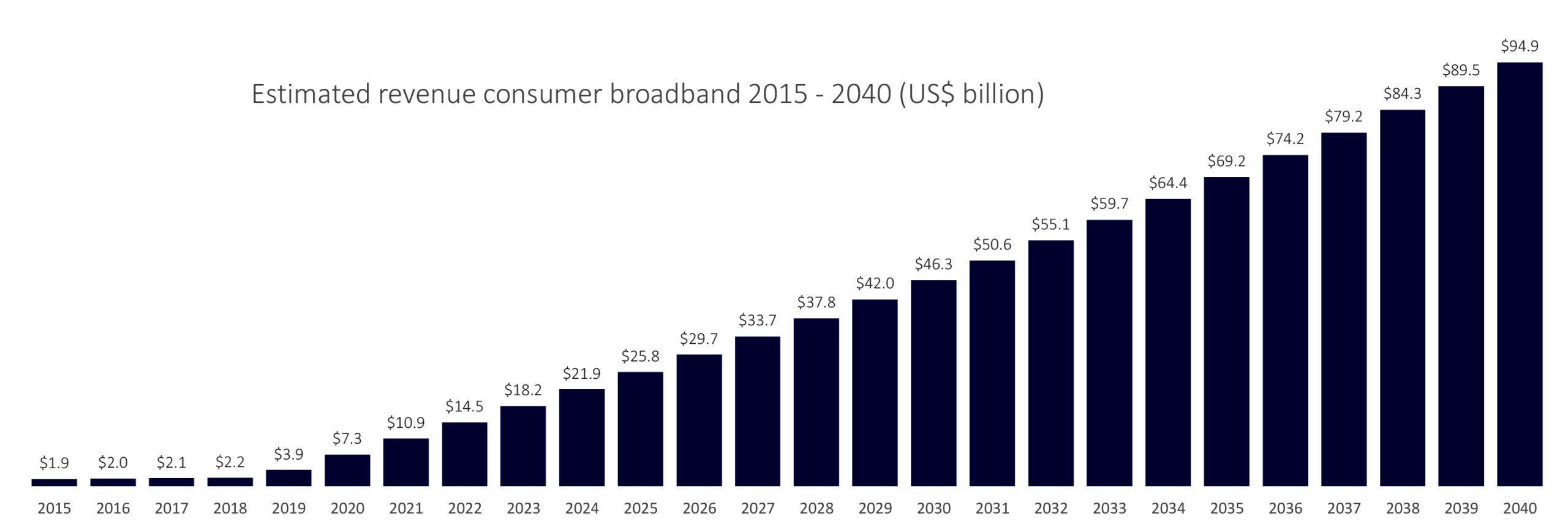

According to a recent Morgan Stanley report on the space industry, the market opportunity is expected to increase to $1 trillion by 2040 from around $350 billion today. Acceleration in growth is being driven by the development of reusable rockets led by SpaceX and Bezos’s Blue Origin. Having reusable rockets dramatically reduces the cost of getting into space making endeavours such as the Kuiper project financially viable.

Summary

Project Kuiper may end up servicing the whole world providing fast reliable bandwidth to people whose economic and social advancement increasingly depends on connectivity. It may well deliver a ubiquitous and stable internet service to Australians before the NBN.