Valuing big tech

Tuesday 14 June 2022

Investing insights

The downturn in the price of high-growth tech stocks has been sudden and has led some commentators to voice concerns about a tech-driven crash similar to the “dotcom bubble” bursting in 1999-2000. This is simply not a fair comparison for our companies.

Big tech value

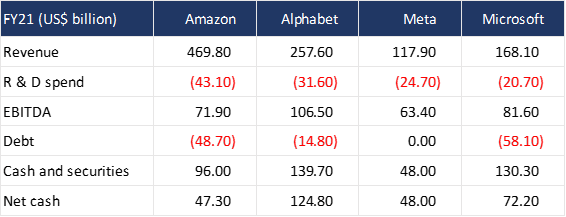

The “dotcom bubble” was characterised by companies with questionable business models. Most had little to no revenue and weak balance sheets. And they were trading on astronomical price multiples¹. To contrast this, below is a snapshot of our largest tech positions and their revenue, operating profit and cash position in FY21. In aggregate their revenues exceed $1 trillion, with a combined cash position of $414 billion.

UBS CEO Ralph Hamers told CNBC at the World Economic Forum in Davos, Switzerland this week:

“It is not like 20 years ago in [the dotcom bubble]. We had some models that were just models on paper and not real. The last 20 years, we have been able to show that there are real changes happening in retail businesses, in financial businesses etc., and that trend is not going to stop because of what we see currently.”

R&D investments

Despite US$323 billion in EBITDA (earnings before interest, tax, depreciation and amortisation) in aggregate, their combined R&D spend is a mind bending $122 billion. These research and development dollars are being spent to improve existing products and develop new products and services. The output will deliver higher revenue and profits in the future.

For example, Google is investing in multi-modal search, expanding text-based search to audio and video. The result will significantly expand the search market and further entrench its competitive position. Amazon is building the largest fulfilment and logistics network in the world, bringing faster delivery to more consumers. Meta is creating virtual reality goggles to bring the Metaverse to life, opening up new worlds for advertising to flourish. And Microsoft is developing its productivity solutions, making work forces smarter and allowing innovation at scale.

In these volatile times, we find it grounding to return to company fundamentals and we are optimistic about the future of our tech stocks. Our companies are not rewarded for maintaining large net cash positions in the good times, however in times of stress, they provide the ability to invest for the future, even if the economy begins to slow.

¹ FY22 EV/EBITDA multiples: Amazon 14.8x, Meta 7.8x, Alphabet 10.6x, Microsoft 19.1x