Disney – Is the COVID rollercoaster stopping?

Thursday 06 May 2021

Portfolio insights

COVID-19 decimated Disney’s Parks, Experiences and Products (PEP) division. Revenue fell by 35% from $26.2 billion in FY19 to just over $17.0 billion in FY20. We anticipate revenue could fall up to 20% further in FY21. New waves of virus outbreaks will impact markets including Europe and Japan. Additionally, physical restrictions mandated in China and Hong Kong will see parks remain closed. However, we believe several factors position the PEP division to benefit from a recovery in FY22 and beyond.

Herd immunity

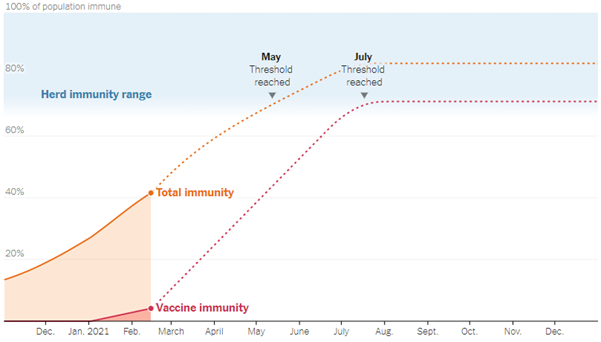

Vaccination rates in the US are advancing more rapidly than originally projected. US President Joe Biden exceeded his original vaccination target of 100 million doses in his first 100 days in office and he recently announced more than 220 million doses were administered over that period. The daily rate has also accelerated to over 3 million per day as more vaccines become available and distribution improves.

More than 80% of US seniors have received at least one dose and the US death rate for the most vulnerable groups has fallen sharply from January levels. In fact, 55% of the adult population have received at least one dose and 30% of adults are fully vaccinated.

At the current pace, the elusive herd immunity figure of 70-90% may be achieved by the end of the northern summer, some models predict. Many states have tied their reopening efforts to the effectiveness of the vaccine rollout, including California, where some of Disney’s largest attractions are located.

The CDC recently relaxed face mask, travel and other mandates for fully vaccinated adults. Others are following their guidelines closely with states, counties and cities amending local policies in lock-step. A more assured sense of their health and welfare as well as unrestricted mobility and improved comfort could be a catalyst for a surge in travel by US citizens this summer.

Post pandemic travel in the US

Disney’s theme parks and attractions remained closed for much of 2020. Most have since reopened, although at reduced capacity. In the initial reopening phase, capacity was capped at 25% due to social distancing requirements. However, improvements in operations, health and hygiene measures, and creative enhancements in industrial design have increased this limit to 35%.

While travel bubbles are being discussed between the US, Europe, Canada, Mexico and other countries, it is likely US tourists will prefer to travel domestically where it is still safer to do so. Further, unrestricted mobility at home and no requirement for face masks will also provide for a more ‘normalised’ tourist experience.

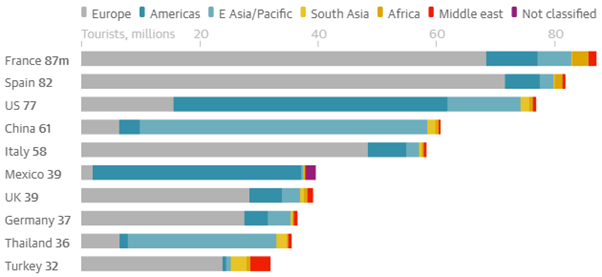

Three-quarters of Disney’s PEP revenue is earned within the USA. Hence a successful reopening for domestic travellers may offset much of the international tourism lost while borders remain closed. Before COVID Americans took approximately 2.3 billion domestic trips each year and around 93 million trips abroad. Inbound international tourists numbered around 80 million, with the majority coming from the Americas and Europe. Potential travel bubbles between the US and Europe could therefore provide further upside.

Pent up demand

In 2019, almost 156 million people visited one of Disney’s parks or resorts. Demand for theme park attendance has far outpaced limited supply since the US parks reopened. Pent-up demand will continue to surge until herd immunity is achieved and physical distancing and face mask restrictions are abolished.

Consumer surveys for cruise line cancellations in 2020 also pointed to excess demand. Given the option of cash refunds or discounted credits for future bookings, the overwhelming majority of travellers chose the latter. A very optimistic sign for the industry. Furthermore, with widespread vaccine rollouts across the globe, cruise lines are selling out cruises for the second half of 2021 out to 2023. Travel Weekly has reported booking records for the period outstripping pre-pandemic levels.

Disney operating improvements

Disney has optimised its operations meaningfully since the pandemic began, to run much more efficiently. Enhancements in industrial design have reduced waiting times at rides while ensuring physical distancing measures are enforced. Disney’s Genie app, which has been widely adopted, has been improved. It now allows visitors to organise, manage and change every aspect of their trip both in advance and on the go, with real-time support.

Other changes identified in Disney customers include increases in online bookings, mobile food ordering and cashless payments. These have not only provided a safer environment for visitors during the pandemic but also offer margin expansion opportunities for PEP over the longer-term. Optimisation across many functions including human resource management, inventory management, marketing functions and more offer operating leverage opportunities once capacity constraints are removed.

With the US vaccine rollout, significant pent-up demand for travel, and improved operations, Disney’s parks are positioned to return to contributing to the company’s overall valuation.