Intel investment thesis

Thursday 15 April 2021

Portfolio updates

Our investment thesis for Intel is based on 4 key points. Structural tailwinds that will provide long-term growth, Intel’s moat widening, new management with a track record for executing, and a valuation that provides a wide margin of safety.

Structural tailwinds

Devices

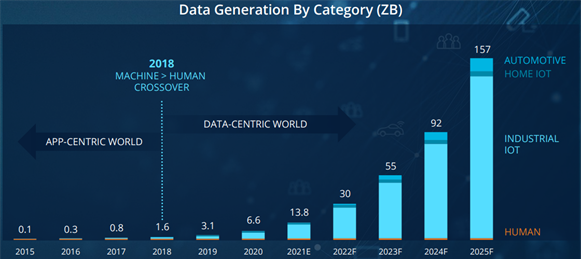

The number of devices and volume of human-generated data has expanded exponentially over the last decade, driven predominantly by mobile phones, tablets, and notebooks. However, future growth will likely be driven by machines with embedded semiconductors, as all things become connected through the Internet of Things. The chart below from Applied Materials shows data generation reaching 157 zettabytes by 2025. However, Cisco has estimated that by 2030 500 billion connected devices will generate 1025 bytes of data, an unfathomable number, orders of magnitude higher than what is shown in this chart.

Data

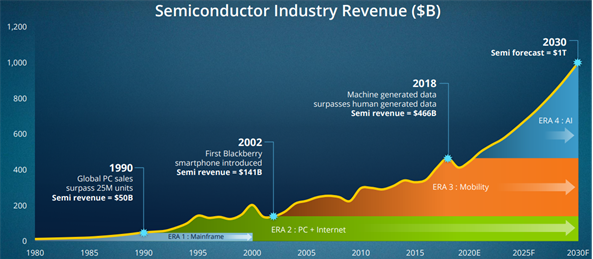

The data explosion together with further expansion of 5G connectivity and cloud computing capabilities will empower greater value extraction. “Data is the new oil” has become the defining refrain of the 21st century as the information economy eclipses the industrial economy in size and value. Like oil, data needs to be refined however, unlike oil it is effectively limitless. Harnessing this data, the next era of computing will be defined by emerging areas such as edge computing, AI and machine learning. As we progress further into the new era, semiconductors will extract greater value than previous generations as hardware becomes increasingly customised and complex. Applied materials forecasts the industry will be worth US$1 trillion annually by 2030.

Digital sovereignty

Intel is the only American manufacturer capable of producing leading-edge semiconductor chips at scale. As a result, it stands to be a major beneficiary of both American and European efforts to re-shore semiconductor manufacturing and bolster local supply chains. President Biden’s American Jobs Plan includes $50 billion for the US semiconductor industry to boost both production and R&D while the EU has announced €145 billion in support for the industry.

Intel’s moat widening

While Intel’s moat has been shrinking for the past 5 years, we believe the company can turn this around, leveraging its scale advantages to deliver long-term growth.

Intel leads the CPU (Central Processing Unit) market with above 75% share. It leads in all metrics including revenue, profit, scale, product portfolio, capacity, and industry partnerships. While AMD, a fabless (pure chip design) company and Intel’s main rival in the space, has been gaining market share, its revenue is still one-tenth of Intel’s, and it is supply constrained by the manufacturing capacities of pure foundry players such as Taiwan Semiconductor Manufacturing Company (TSMC).

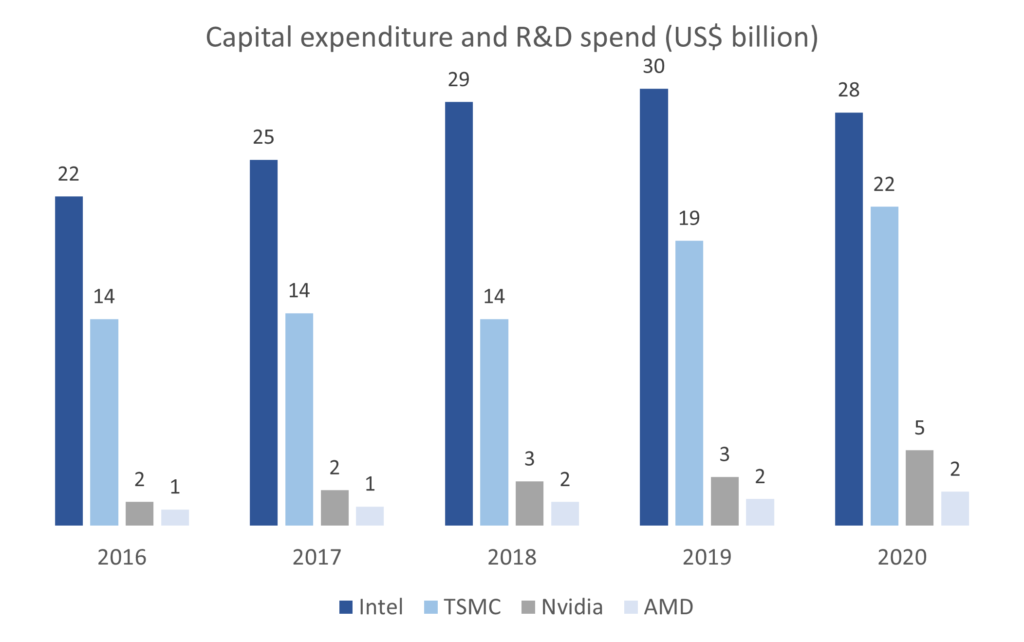

With greater revenue and scale, Intel can invest heavily in leading-edge technologies that require upfront investments and provide sustainable returns over the long term. The capacity to invest is key as R&D and fab module construction costs increase with the increasing complexity of each new generation of chips. Each generation is typically described by the feature size of the transistors on the chip as measured in nanometres (nm). McKinsey estimates chip design cost has increased from $36 million at 40nm to $540 million at 5nm while construction costs have increased from $0.7 billion to $5.4 billion. This has left only three players in the leading-edge manufacturing market, Intel, TSMC, and Samsung.

New management

Intel’s new CEO, Pat Gelsinger, has a clear strategy to address the key issues that have led to the company’s underperformance: a manufacturing process lag driven by an unhealthy corporate culture.

Following its heydays in the 80s and 90s under Andy Grove, a legendary manager who pioneered management methods for creating highly productive teams, Intel’s culture began to slip. Complacency, as evidenced by the company’s refusal to make smartphone chips and its reluctance to adopt new production technologies began creeping in. Over time Intel’s manufacturing lead was eroded by pure-play foundries TSMC and Samsung Electronics opening the door to fabless chip companies to compete with Intel on the design side.

However, as bad as this sounds, the company’s fall from grace can be traced back to key management missteps and we believe Intel will be able to turn the ship around with strong leadership and good execution under new management.

Pat Gelsinger was appointed CEO in February, departing his role as CEO of VMware where he led the company’s tremendous expansion, tripling revenue and doubling its market value. He is not new to Intel, having spent 30 years there early in his career, contributing to Intel’s early breakthroughs and its processing prowess.

Gelsinger’s strategy

- Admit mistakes and embrace solutions

Identifying the problem: “When Intel initially designed 7-nanometer chips, EUV (extreme ultraviolet) was still a nascent technology so we developed our process to limit the use of EUV. But this also increased the process complexity. As EUV then matured and became more reliable, we experienced the domino effects of our 10-nanometer delay which pushed out 7-nanometers and ultimately put us on the wrong side of the EUV maturity curve.”

Executing the solution: “I’m pleased to share that we have now fully embraced EUV. We’ve re-architected and simplified our 7-nanometer process flow, increasing our use of EUV by more than 100%.”

- Renew Intel culture focused on execution

As noted previously, Intel thrived under the constructive and innovative corporate culture fostered by Andy Grove, Intel’s CEO from 1987 to 1998.

“We’re bringing back the execution discipline of Intel. I call it the Grovian culture that we do what we say we will do. That we have that confidence in our execution. That our teams are fired up. That we said we’re going to do x, we’re going to 1.1x every time that we make a commitment. That’s the Intel culture that we are bringing back.”

- Invest in the right areas – growing segments within Intel’s moat

Rather than continue focusing on cost savings to improve short-term results, Gelsinger announced significant manufacturing expansion plans starting with a $20 billion investment to build two new leading-edge factories in the US. Also, Gelsinger’s new IDM 2.0 strategy will see Intel make chips for other chip designers and will also outsource production of some of its own chips to external foundries where it makes economic sense to do so.

Valuation

The final part of the thesis is the valuation. Intel’s current valuation provides a wide margin of safety. The company trades on a 12-month trailing P/E of 12x compared to the semiconductor industry’s P/E of 24x. The prevailing expectation is for Intel to grow at less than half the industry’s growth rate of 8% with flat margins. With good execution of its strategy, Intel could not only grow significantly faster but could also expand margins. Given these factors, we believe Intel has significant return asymmetry with low downside risk.

Taken together, these four points, structural tailwinds, expanding moat, new management and valuation make Intel an attractive long-term investment. We look forward to seeing the company execute on its purpose “to create world-changing technology that enriches the lives of every person on earth”.