Tencent’s game plans

Monday 22 March 2021

Portfolio insights

Tencent is the sixth most valuable company in the world, with a market cap close to $800 billion. The Chinese conglomerate has a growing and diversified revenue stream, operating in social networks, online gaming, media entertainment and advertising, e-commerce, fintech and other business services.

It has created an ecosystem of apps at the core of its business model; more apps and greater utility derived from these drive further engagement and create stickier consumers, attracting more app developers, businesses and merchants, which provides further utility to users and so forth. This self-reinforcing flywheel is what powers both its network effects and ultimately expands its moat.

Extending the social media value chain

Tencent hosts China’s leading social network apps including WeChat and QQ, which had a combined 1.8 billion active monthly users as at Q3 2020, with the latest statistics suggesting over 900 million people use WeChat daily. Since its launch, the company has extended the two apps beyond simple messaging into many other segments including payments, alternative finance, e-commerce, games, food deliveries, ride-hailing and more.

The company launched its famed mini-programs initiative in 2017 offering advanced features across its platform. For example, Tesla has a mini-program that enables users to locate charging stations, schedule a test-drive and share their experiences about driving a Tesla. China’s second largest e-commerce retailer, JD.com, has developed a mini-program that allows seamless shopping experiences in-app. Pinduoduo has its own mini-program that some of its users engage with vigorously to follow coupon deals, and Meituan, China’s largest platform for services, has mini-programs that provide instant access to local businesses for almost any service.

The mini-programs allow these services to be built completely within WeChat, making access faster by reducing load speed and maximising the user experience through tight integration and easy navigation across services.

Targeted investments

The gradual expansion of Tencent’s own apps and operating segments, as well as the rollout of the mini-programs initiative have been key to its growth over the past decade. Its aggressive investments over the same period have complemented both strategies, while creating high returns and windfalls for the company. Its investment strategy is summarised well within its latest financial report:

“We manage our investment portfolio with a primary objective to strengthen our leading position in core businesses and complement our “Connection” strategy in various industries, particularly in social and digital content, O2O and smart retail sectors. We also invest in transportation, FinTech, cloud and other sectors.”

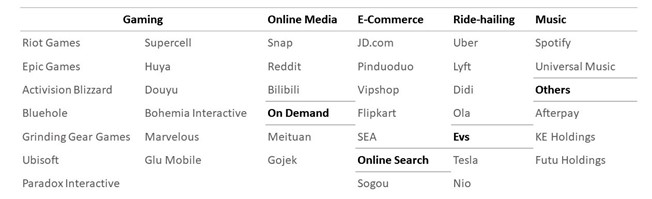

The company reportedly owns stakes in nearly 1,200 global companies, around 100 of which are publicly listed. Many of the startups they have championed provide complementary products and services to those already offered within its ecosystem. They also allow Tencent staff to keep their finger on the pulse of new technologies and emerging industries, positioning themselves to benefit from those with the highest prospects of success or likelihood of adoption. The company can also gain access to talent or products from these companies, such as promising titles from game developers or back catalogues from music producers.

A recent analysis in “The Information” estimates Tencent’s stakes in these businesses cost $80 billion and were reportedly worth more than $280 billion at the end of 2020.

Riot Games

Tencent purchased a majority stake (93%) of Riot Games in 2011 for $400 million and took full ownership of the game developer in 2015 after it purchased the final 7% for an undisclosed amount. One of its main gaming titles, League of Legends, has become the most popular PC game in the world and generated around $10.2 billion in revenue including $1.75 billion last year. The market value of Riot today is around $25 billion.

It is likely the potential investment returns were not the primary driver for the company’s initial interest in Riot. Access to its popular League of Legends, which was released two years earlier, as well as future titles developed by Riot’s studio probably created enough value for Tencent to justify the investment at the time. Both companies benefitted from the deal as China presented a massive growth market for Riot, while Tencent, through a distribution deal for Riot title releases in China, could grow its gaming revenue significantly. China now accounts for over 60% of global revenue from League of Legends.

Mobile gaming opportunity

Tencent saw the rising popularity of mobile gaming in Southeast Asia as one of its key strategic priorities and wanted to create a mobile version of League of Legends for the local market. Key personnel at Riot thought a mobile version of the game would be inferior to its PC experience, so refused to develop it. Tencent went on to create its own clone version called Honor of Kings through another of its gaming subsidiaries, Timi Studios, which became the most popular smartphone game in China by the end of 2017. In fact, the title has achieved US$7.8 billion since its release in 2015, with over 96% of this derived within China.

Late last year, Honor of Kings became the first game in the world on any platform to average more than 100 million daily active users and still sits in number one spot for App store revenues according to Sensor Tower rankings. Timi is now a global leader in mobile game development, releasing successful mobile titles including PUGB: Army Attack, Call of Duty: Mobile and Pokemon UNITE.

Impressive ROI

Tencent’s return on its initial investment in Riot (estimated to be around US$0.5 billion) has been impressive. Following the acquisition in 2011, it gained access to leading game titles for its Chinese market, helping its online gaming revenues grow over seven times from $35.7 billion in 2012 to an estimated $268.2 billion in 2020. It became the de facto global leader for e-Sports and continues to grow revenue through livestreaming, advertising, TV shows and merchandising.

Similar returns have been realised from investments in other gaming studios such as Epic Games, Activision Blizzard, Bluehole (PUGB), Grinding Gear Games, Supercell, Ubisoft, Voodoo, Shanda Games, Huya and Douyu. Advisory firm Digi-Capital estimated in 2018 that Tencent led or participated in $4 of every $10 invested in games companies worldwide and was part of 75% of all M&A deal value in worldwide gaming.

The company’s other investments follow a similar strategy. For example, its minority stakes in Meituan, Pinduoduo and JD.com have increased its share of digital wallet spend from Chinese consumers, while providing their own incredible investment gains.