Could Facebook host the next computing platform?

Wednesday 17 March 2021

Portfolio insights

In 2017 we suggested Augmented Reality/Virtual Reality could be the next computing platform, with forecast sales of $80 billion by 2025. At the time Apple had just launched its ARKit framework, Microsoft had launched its HoloLens headset, and Magic Leap had raised $2 billion to develop its highly secretive Magic Leap 1.

Terminology

Over the course of four years many things have changed including our understanding of the technology, and its worth clarifying how we now define the various terms. Virtual reality (VR) is a complete virtual environment. Once you put a headset on you have no reference to the outside world and are completely immersed in the digital realm. Augmented reality (AR) is what you find in most first-generation smart glasses or heads-up displays. It offers a digital information overlay for the real world.

More recently, mixed reality (MR) has been used to describe a combination of AR and VR. It can project virtual objects into the field of view that can be manipulated by the user and are contextually aware meaning they interact with your environment. The collective term for these ‘realities’ is extended reality or XR which we’ll use when referring to the group.

Historical context

Looking back on our 2017 piece, several things are apparent. Firstly, 2016-17 was clearly the peak of inflated expectations for XR and its near-term prospects. While everyone saw how impactful the technology could be, most underestimated how long it would take to develop. It remains behind the current computing paradigm of smart phones and desktops in terms of the user experience.

Secondly and perhaps more importantly, most people significantly underestimated the long-term potential of XR. Initial estimates of $80 billion in sales by 2025 have since been increased to $300 billion with the industry expected to generate $30 billion in sales this year.

This is particularly common in tech, where people tend to overestimate what is achievable in the short-term and underestimate what is achievable in the long-term. We prefer to remain focused on the long-term when thinking about our investments.

“…it’s very difficult to solve big problems in 4 years. I think it’s probably pretty easy to do it in 20 years” – Google Co-Founder Larry Page

The value is in the platform

One factor we noted in 2017 that remains true today is that the winner in the XR race is likely to be the company that builds the most widely adopted platform. From the article:

“We believe the value will be in the software platforms. The platform that enables developers to easily build the best applications for AR will have a significant advantage. The major tech companies have all realised this and are now competing to build their own AR platforms.”

The platform would likely become the next operating system like Windows, iOS or Android. This business model has strong network effects where more users = more developers = more apps = more users, creating a flywheel that extends the leader’s moat. As we have seen in the past with the PC and then mobile, whichever company reaches critical mass first will be very hard to unseat.

In a recent interview with The Information, Facebook CEO Mark Zuckerberg said he thought 10 million was the critical number of devices at which the size of the network would kickstart this flywheel effect.

“…we believed that if we get to 10 million units active, then that’s kind of a critical magic number. At that point, you have a self-sustaining ecosystem.”

The race to scale

Several companies are competing to create the XR operating system including Microsoft, Apple and Magic Leap, but Facebook has one key advantage over its peers: It has targeted its investments towards VR first.

While MR has more potential to be transformational, we believe it is still far from reaching widespread consumer adoption. This is because to get people to adopt a new technology, it needs to be either significantly better or significantly cheaper than the status quo. Unfortunately for MR, the current slate of devices is neither. Microsoft’s HoloLens 2, which is arguably the leader in MR, starts at A$5,600 while the Magic Leap 1 headset costs around A$3,000. Apple is due to enter the race in 2022 with a unit that could be priced between US$1,000 and $3,000.

In addition, the current MR form factor is bulky, has a narrow field of view, a clunky hands-free interface and is painful to use for extended periods of time. As a high-end smart phone is less than $500 few people are likely to want to spend up to ten times more for a device that offers an inferior experience.

Facebook’s VR journey

Despite the obvious limitations of VR, Facebook focused on it, believing it will be widely accessible sooner than MR. As a result the current Oculus Quest 2 headset is portable and sells for just US$299, a realistic price for many users.

“That’s the next big push: how do we get the technology to be more accessible to more people? A big part of that was driving it to be more affordable and making it more portable.”– Mark Zuckerberg on the Information’s 411 podcast

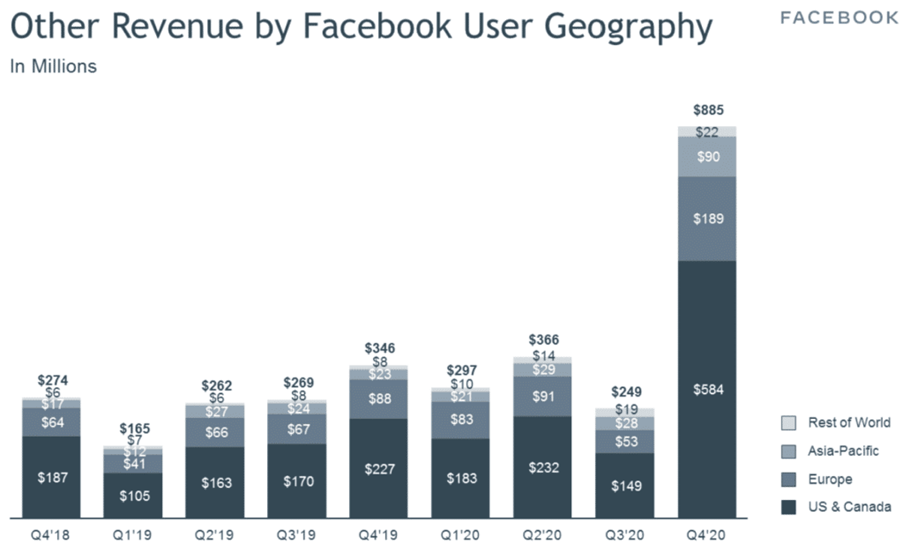

While Facebook does not disclose unit sales of its VR headsets, in 2019 it surpassed $100 million in content sales on its Oculus platform. By the end of 2020, 60 apps had earned more than $1 million and six had surpassed $10 million in sales. The company acknowledged Oculus was a driving force behind the 156% increase in non-advertising revenue in 4Q20.

Zuckerberg believes Facebook’s VR-first strategy will reach 10 million users in the next few years. By the time MR is more affordable, Facebook may already have a thriving ecosystem, and a possible transition to adapt the platform for MR headsets will be relatively frictionless as it will already have reached critical mass. Facebooks platform could become the unifying platform for all XR devices.

The market is not accounting for the XR opportunity in Facebook’s current valuation. Perhaps this is shortsightedness or lingering regulatory fear. Either way it presents a unique opportunity for Facebook.

DISCLAIMER This document has been prepared without consideration of any specific clients investment objectives, financial situation or needs. While this document is based on information from sources which are considered reliable, Swell Asset Management, its directors and employees do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or accurate. Any views expressed are taken to be those of the individual author, except where the author specifically attributes those views to Swell Asset Management and is authorised to do so. Swell Asset Management is an authorised representative of Hughes Funds Management Pty Limited ACN 167 950 236 AFSL 460572.