The bubble is in growth!

Thursday 04 March 2021

Investing insights

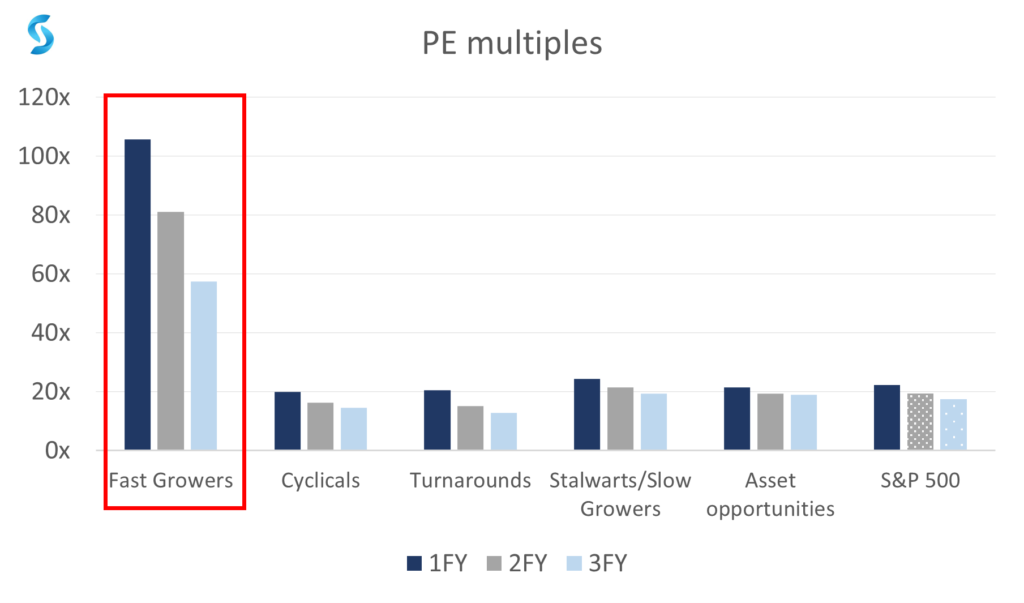

While monitoring the 100 or so stocks on our watchlist this week we noticed something interesting. If you categorise the companies by their business characteristics into the five buckets shown below (adapted from legendary investor Peter Lynch), the high growth companies (‘fast growers’) are trading on forward multiples 4-5x higher than the market.

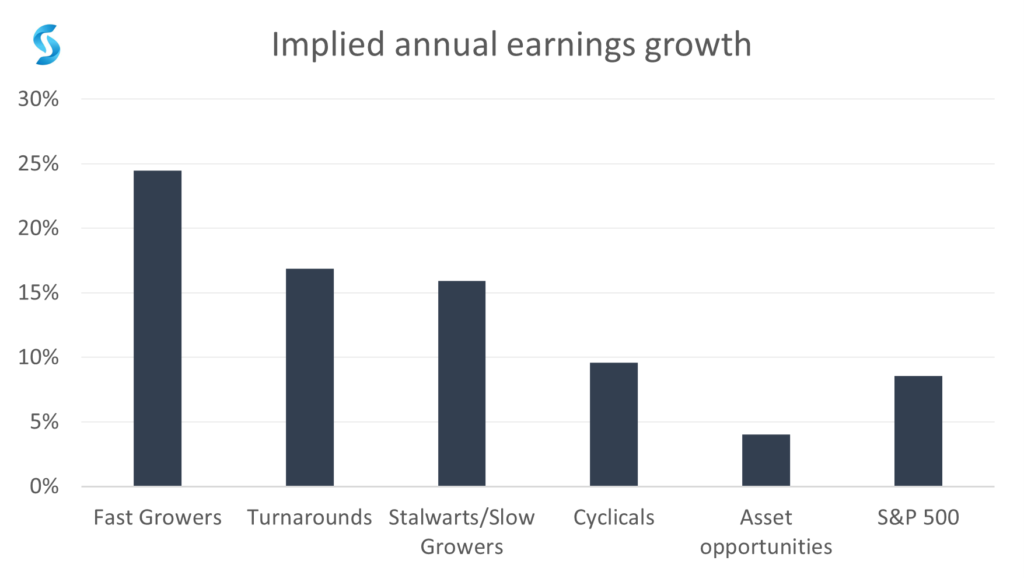

Clearly the market is favouring high growth above all else. High multiples are sometimes justified if the company’s future earnings are expected to grow rapidly. However, when we look at the implied annual earnings growth of the fast growers relative to the others, the growth does not justify the price.

Is it worth paying 4-5 times more for a stock with a few extra percentage points of earnings growth? As value investors we don’t think so as it removes the margin of safety. In other words, there is no room for these fast growers to miss their earnings projections, which is a real risk.

We believe these high growth stocks do not represent value. That is why we continue to focus on acquiring high quality businesses at discounts to their intrinsic value.