John Deere’s technology edge

Tuesday 23 February 2021

Portfolio insights

John Deere reported its first quarter results on Friday, far surpassing the market’s expectations, with worldwide net sales growth of 23% and profit up 137% year-over-year.

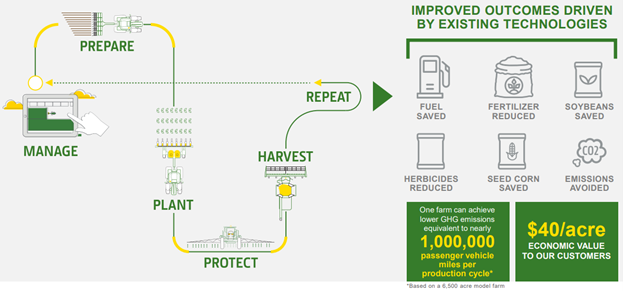

The results reflected a confirmation of our thesis that technology upgrades and growing adoption of precision agriculture would facilitate sustained growth in the average selling price of its equipment and maintain margin expansion as software becomes a growing proportion of its operating margin mix.

Much like Apple, John Deere is using software to differentiate its hardware. By demonstrating measurable improvements in both farm profitability and sustainable operations through technology upgrades from both new and used equipment, John Deere can significantly improve the return on investment and payback on its equipment and machinery.

Tailwinds

Many tailwinds behind the company are expected to provide support for continued growth and ensure execution on its goals. Demand for farm machinery is high, buoyed by significantly improved farm profitability and farmer sentiment. Commodity prices have improved and many are at historically high levels, while interest rates remain low and are expected to remain depressed for some time, making large investments in machinery more affordable.

Most importantly, the average age of farm inventory remains near historically high levels, which is expected to facilitate a strong replacement cycle over coming months and years.

We remain confident John Deere will maintain its status as a technology leader among global equipment manufacturers.