Rising volatility

Monday 22 February 2021

Investing insights

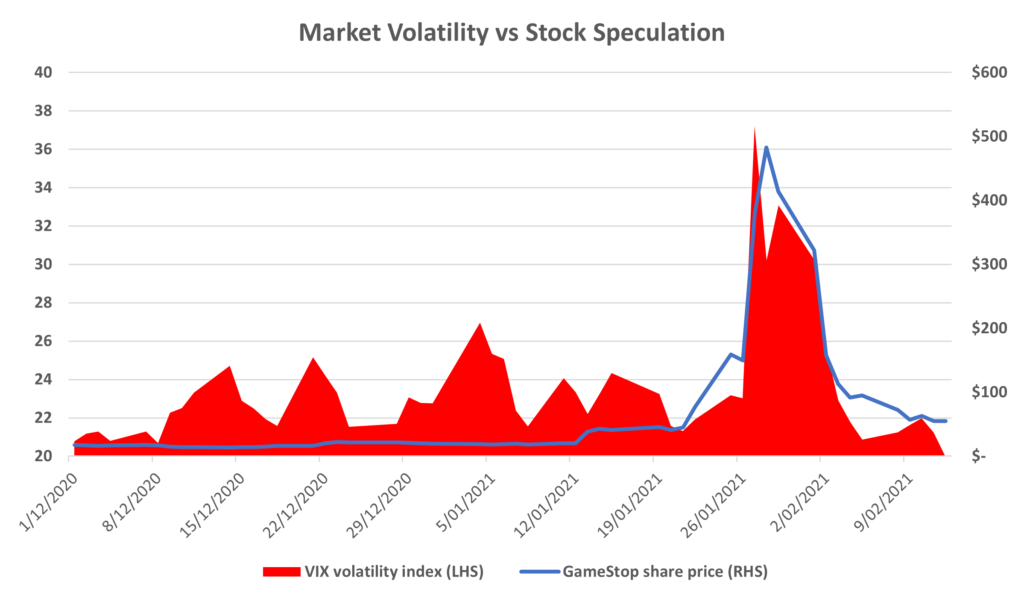

Recent bouts of market volatility have confirmed prolonged uncertainty in the economic environment until the COVID-19 pandemic is under control. Adding to the economic uncertainty investors must grapple with is a huge increase in the number of retail investors entering the equities market.

Retail traders

According to Bloomberg Intelligence, retail traders accounted for only 10.1% of total trades in the US in 2010, and that number rose to 14.9% by 2019. A mixture of lockdowns, work-from-home, large stimulus checks and lack of live sports betting created an environment for that figure to more than double over the past twelve months, with retail traders accounting for over 30.0% of trades in 2021 according to Credit Suisse.

Trading volumes

A second data point impacting volatility is trading volume. In a recent interview on CNBC, Managing Director at Piper Sandler, Richard Repetto observed that trading volumes have more than doubled year-over-year and some brokerage firms are handling 3-4 times more transactions than historical norms. The increased trading activity may reflect an uncertain operating environment and outlook for businesses but it also points to increased speculation from retail investors in specific companies and industries.

Valuations have been very difficult to reconcile with current market prices for many companies. Even if new businesses capture most of the opportunities within the industries they are disrupting, expand into new areas of business and execute perfectly, their valuations are difficult to sustain over the longer term, for example electric vehicles and buy-now-pay-later.

Options

A third data point is the increased number of options contracts. Almost 40 million options contracts were traded daily in January 2021 and many inexperienced traders were caught in the r/WallStreetBets (WSB) Game Stop shorting activity during the month, with stock’s value dropping from its high of $347 to less than $50 today.

A stock pickers market

Some companies and pockets of the market appear frothy, but not all. This is a stock picker’s market more than at any other time over the past decade. The pandemic has changed the economic landscape and some companies will indeed benefit substantially from changing trends and persistent tailwinds. There will undoubtedly be winners and losers but importantly, even the winners have a price if you want to generate a return on your investment, as demonstrated by our recent choice to sell portfolio holdings such as Apple and Starbucks when prices far outweighed valuations.